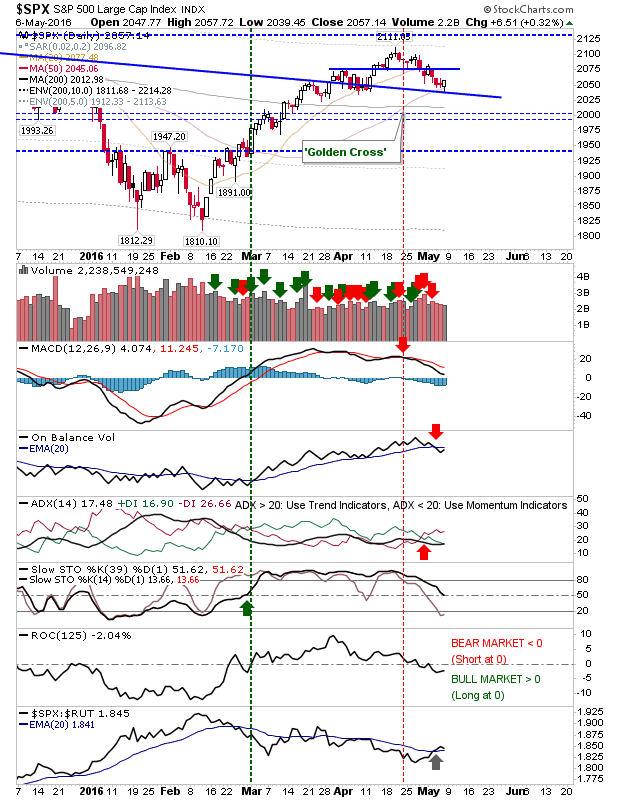

Friday delivered a positive end-of-week close after a sequence of down days. Volume was not impressive and was below mid-week selling.

The S&P dug in at its 50-day MA, but is holding to 'sell' triggers in the MACD, On-Balance-Volume, and -DI/+DI. Relative performance finished the week with Large Cap strength overall Small Caps. Rate-of-Chart moved back to the bullish mid-line in what could offer itself as bullish buyback opportunity.

The Nasdaq remains above nearest support on net bearish technicals. The premise for a swing low could be on offer if there is a gap higher on Monday, but the index looks to be in a bit of a no-mans land with converging resistance of 20-day, 50-day, and 200-day MAs overhead.

The Russell 2000 finished with a bullish hammer with a low tag of the 50-day MA. Slow Stochastics [39,1] is down at potential mid-line support and is holding to strong out-performance relative to the Nasdaq.

The Semiconductor Index found support at 200-day MA with converged oversold stochastics of [39,1] and [14,3]. Aggressive buyers may look to take advantage of the dip.

The relative relationship between Staples and Discretionary bounced weakly for April and ticked lower for the first part of May. Technicals in this relationship remain bearish and are some way from oversold levels typical of a solid swing low in the broader market.

In general terms, Commodities remain in deep discount territory, but Global Stocks look overvalued.

For Monday, bulls should look to the Semiconductor Index and S&P for leads. A positive start will also help Small Caps return above former channel support. If there is a slow start to the week, then the Nasdaq has the potential to drift lower without the need for active selling, but should sellers make an appearance then it could be painful.

You've now read my opinion, next read

Douglas' and

Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for

ChartDNA.com, and Product Development Manager for

FirstDerivatives.com. I also trade on

eToro and can be copied for free.