Losses Outscore Gains

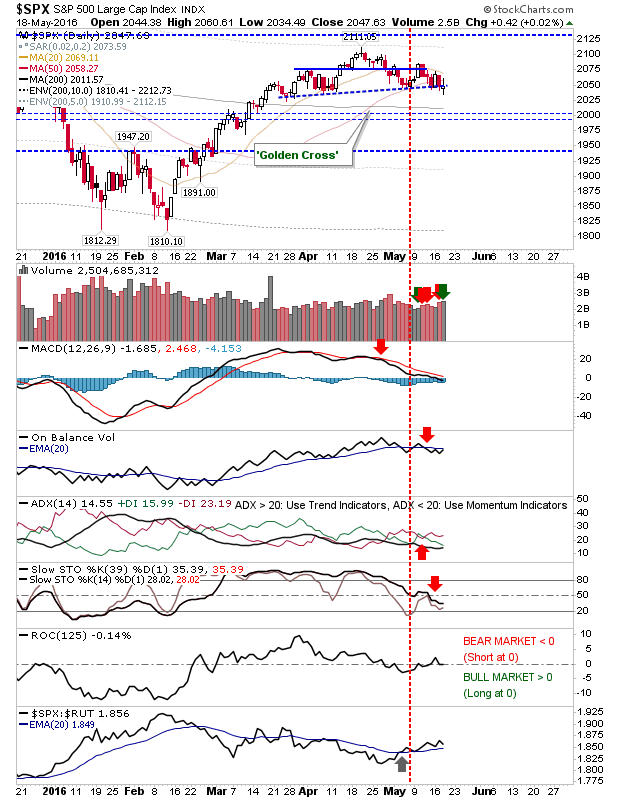

Small gains fail to recover yesterday's losses. The trend is down, but losses are still modest - thanks to these regular gains. The S&P is still clinging on to the neckline of the head-and-shoulder pattern. Volume climbed to register an accumulation day, but the 'spinning top' finish for the day leaves things in a more neutral state. A swing-trade using day's highs/lows as the trigger would be ideal, but an inside day would offer better risk:reward.

After an extended period of relative outperformance by the Russell 2000 against the Nasdaq, the Russell 2000 has begun a period of underperformance with supporting technicals bearish. The failure to recover the 50-day MA along with the downtrending 200-day MA compounds the bearish picture.

The Nasdaq remains below the 20-day, 50-day, 200-day MAs on net bearish technicals. So while it may be outperforming against the Russell 2000, it's not doing so from a position of strength. However, the silver lining for the index is the building swing low in the Semiconductor Index.

For tomorrow, bulls should look for a bounce opportunity off neckline support in the S&P, and the potential for a rally through converged support in the Nasdaq; the latter would likely see a swathe of short covering given the negative technical picture. The Russell 2000 is not offering a clear risk:reward trade.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

After an extended period of relative outperformance by the Russell 2000 against the Nasdaq, the Russell 2000 has begun a period of underperformance with supporting technicals bearish. The failure to recover the 50-day MA along with the downtrending 200-day MA compounds the bearish picture.

The Nasdaq remains below the 20-day, 50-day, 200-day MAs on net bearish technicals. So while it may be outperforming against the Russell 2000, it's not doing so from a position of strength. However, the silver lining for the index is the building swing low in the Semiconductor Index.

For tomorrow, bulls should look for a bounce opportunity off neckline support in the S&P, and the potential for a rally through converged support in the Nasdaq; the latter would likely see a swathe of short covering given the negative technical picture. The Russell 2000 is not offering a clear risk:reward trade.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.