Friday Accumulation

Indices finished the week strongly, pushing a follow through to Thursday's gain. Volume climbed to register an accumulation day. Indices still have to contend with moving averages as resistance, but get above these and there is room to run to all-time highs from last year.

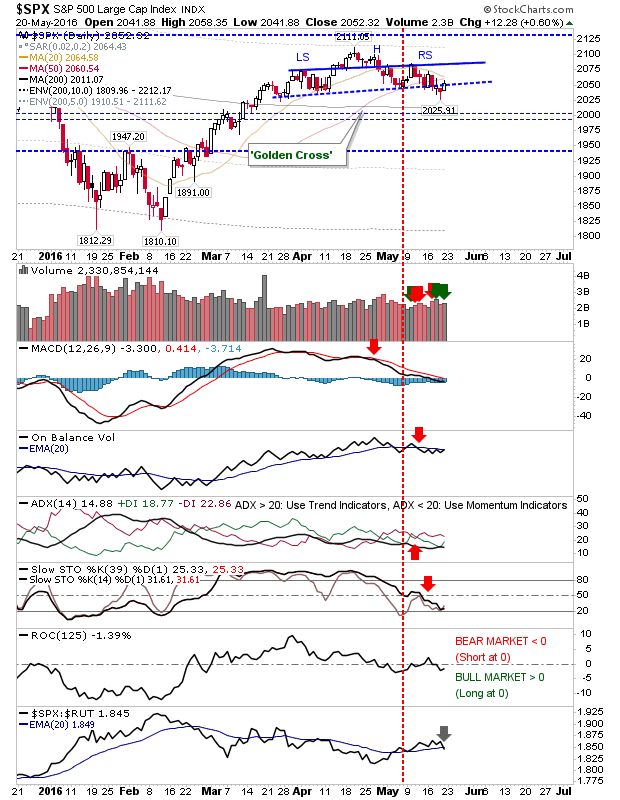

The S&P is back at converged 20-day and 50-day MAs which is also the neckline of the head-and-shoulder pattern. If bears are to retain control then the neckline has to hold as resistance, which means there is little room for additional gains. Relative performance has switched to under performance against Small Caps.

The Nasdaq remains inside the May trading range, but technicals are slowly improving. The MACD is on the verge of new 'buy' trigger (although below the bullish zero line - a weak signal), and soon may be followed with an On-Balance-Volume trigger.

The Russell 2000 is edging a breakout from a declining channel, but only 9 points separate the 20-day, 50-day and 200-day MAs which have to be overcome if the channel breakout is to be confirmed. Relative performance is close to a bullish trigger. Technicals are down near lows but haven't reached oversold levels.

The real winner on Friday was the Semiconductor Index. The index returned inside March-April consolidation with a 3% gain on a bullish cross of the 50-day MA. Technicals are on the verge of turning net bullish with slow stochastics the last of MACD, CCI and ADX to turn bullish. Relative performance of Semiconductors to the Nasdaq 100 is also near a new near term high. As an economic indicator, Semiconductor strength is a positive and offers secular bulls something to track in the weeks ahead.

For tomorrow, watch for opening gaps that start indices above moving averages. If these gaps can be held in the opening 30 minutes it will set up a combination for short covering and new (long term?) buyers. Given Friday's action in the Semiconductor Index, the Nasdaq and Nasdaq 100 may offer the best risk:reward.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro,

register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.

The S&P is back at converged 20-day and 50-day MAs which is also the neckline of the head-and-shoulder pattern. If bears are to retain control then the neckline has to hold as resistance, which means there is little room for additional gains. Relative performance has switched to under performance against Small Caps.

The Nasdaq remains inside the May trading range, but technicals are slowly improving. The MACD is on the verge of new 'buy' trigger (although below the bullish zero line - a weak signal), and soon may be followed with an On-Balance-Volume trigger.

The Russell 2000 is edging a breakout from a declining channel, but only 9 points separate the 20-day, 50-day and 200-day MAs which have to be overcome if the channel breakout is to be confirmed. Relative performance is close to a bullish trigger. Technicals are down near lows but haven't reached oversold levels.

The real winner on Friday was the Semiconductor Index. The index returned inside March-April consolidation with a 3% gain on a bullish cross of the 50-day MA. Technicals are on the verge of turning net bullish with slow stochastics the last of MACD, CCI and ADX to turn bullish. Relative performance of Semiconductors to the Nasdaq 100 is also near a new near term high. As an economic indicator, Semiconductor strength is a positive and offers secular bulls something to track in the weeks ahead.

For tomorrow, watch for opening gaps that start indices above moving averages. If these gaps can be held in the opening 30 minutes it will set up a combination for short covering and new (long term?) buyers. Given Friday's action in the Semiconductor Index, the Nasdaq and Nasdaq 100 may offer the best risk:reward.

You've now read my opinion, next read Douglas' and Jani's.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro,

register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for ChartDNA.com, and Product Development Manager for FirstDerivatives.com. I also trade on eToro and can be copied for free.