Sellers Deliver Second Day Of Losses

A little more damaging than Friday in that early gains couldn't stick in what would have been a respectable rebuttal of those losses.

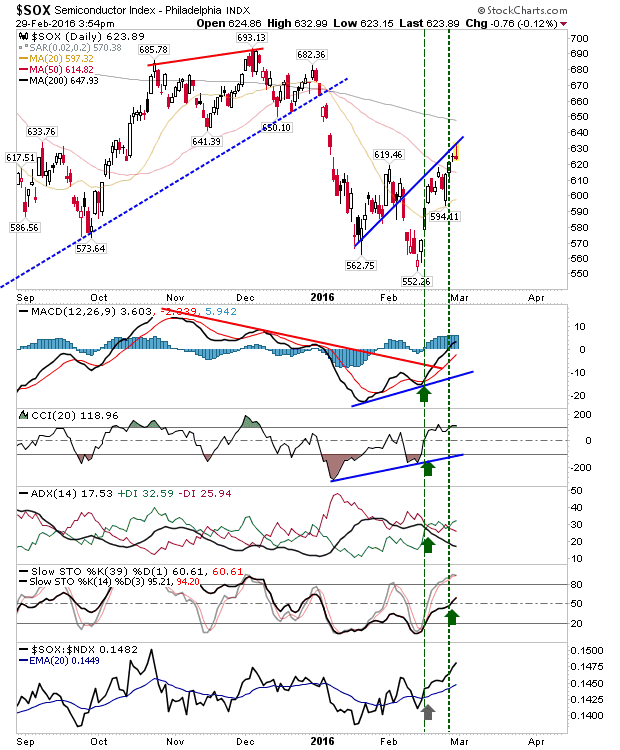

The Semiconductors managed a perfect tag of resistance before it headed south. Shorts will have had the best of the opportunities today, although technicals are still net bullish.

The S&P edged below 1,940 support, but remains close enough to its 50-day MA to still be considered at both support levels - although another day of losses won't be tolerated.

The Nasdaq had already tagged resistance and today's action simply confirmed such resistance. Technicals are net bearish, although there is continued bullish improvement for On-Balance-Volume and MACD.

The Russell 2000 tagged resistance of its 50-day MA before it reversed. Like the Nasdaq it's dealing with net bearish technical strength.

Tomorrow will be a case of minimizing losses and exhausting Shorts of opportunities while waiting for buyers to return

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I also trade on eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!

The Semiconductors managed a perfect tag of resistance before it headed south. Shorts will have had the best of the opportunities today, although technicals are still net bullish.

The S&P edged below 1,940 support, but remains close enough to its 50-day MA to still be considered at both support levels - although another day of losses won't be tolerated.

The Nasdaq had already tagged resistance and today's action simply confirmed such resistance. Technicals are net bearish, although there is continued bullish improvement for On-Balance-Volume and MACD.

The Russell 2000 tagged resistance of its 50-day MA before it reversed. Like the Nasdaq it's dealing with net bearish technical strength.

Tomorrow will be a case of minimizing losses and exhausting Shorts of opportunities while waiting for buyers to return

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I also trade on eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!