Second Day of Gains

Finally, some good news for my Kinder Morgan shares, although it's unlikely I'll see this back to my cost basis until 2017. As for the indices, it was a solid day, even if volume was a little light.

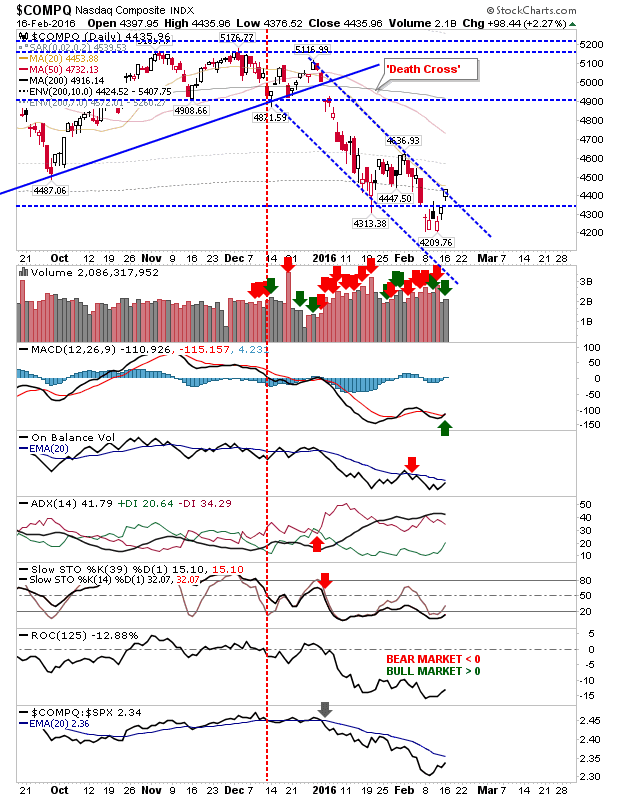

The Nasdaq looks ready to break from its channel. Today registered as an accumulation day with a fresh MACD trigger 'buy'. There may be room for a rally back to the 50-day and/or 200-day MA (or 4,900). Beyond that and things may get more difficult.

The S&P registered a 'buy' trigger in the MACD, but not the volume to record an accumulation day. The move back to 1,947 sets up for a double bottom, but it's 2,000 which is the real level of interest.

The Dow is running a little ahead of the S&P. Gains tomorrow puts it into the upper level of its 2016 consolidation. However, 16,500 is the real resistance level.

The Russell 2000 is looking to build a relative advantage. Getting back inside its prior wedge consolidation would be a start. There is a healthy bullish divergence in the MACD with a matching 'buy' trigger.

The easier path from here - given the deep oversold nature of the market in 2016 - is probably higher. The question is how well markets react once they get back to their respective 200-day MAs. Look to individual stocks for value.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I also trade on eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq looks ready to break from its channel. Today registered as an accumulation day with a fresh MACD trigger 'buy'. There may be room for a rally back to the 50-day and/or 200-day MA (or 4,900). Beyond that and things may get more difficult.

The S&P registered a 'buy' trigger in the MACD, but not the volume to record an accumulation day. The move back to 1,947 sets up for a double bottom, but it's 2,000 which is the real level of interest.

The Dow is running a little ahead of the S&P. Gains tomorrow puts it into the upper level of its 2016 consolidation. However, 16,500 is the real resistance level.

The Russell 2000 is looking to build a relative advantage. Getting back inside its prior wedge consolidation would be a start. There is a healthy bullish divergence in the MACD with a matching 'buy' trigger.

The easier path from here - given the deep oversold nature of the market in 2016 - is probably higher. The question is how well markets react once they get back to their respective 200-day MAs. Look to individual stocks for value.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I also trade on eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!