Pause in Action

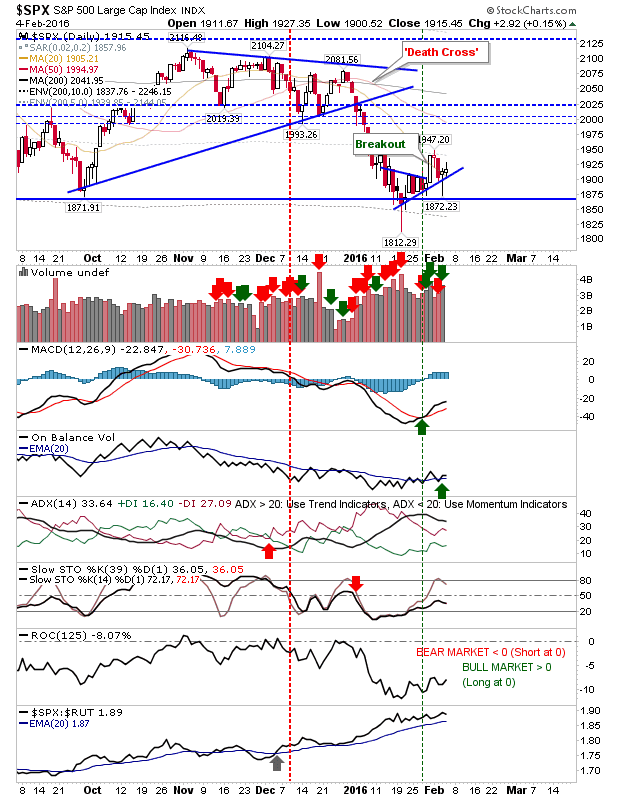

Small Gains as indecision held sway. The S&P finished inside the range of last Friday's breakout and held rising support, but the index did the minimum to pacify bulls.

The Nasdaq breakout has eased alongside former resistance turned support. Volume was lighter, and the spinning top finish marks indecision. While Thursday's action offered no side an advantage, a push towards 4,900 would appear to be the favoured path.

The Russell 2000 is caught inside the apex of support and resistance, but as the consolidation appeared below support in what is increasingly looking like a failed 'bear trap', a push lower would appear to be the easier path.

The Semiconductor Index is working a swing low, but a solid move higher is required to confirm.

There is more to do for bulls to confirm the low. Today's action didn't give either side an advantage, but Friday might offer a firmer idea as to what is to follow. NFP data will not be left wanting.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I also trade on eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq breakout has eased alongside former resistance turned support. Volume was lighter, and the spinning top finish marks indecision. While Thursday's action offered no side an advantage, a push towards 4,900 would appear to be the favoured path.

The Russell 2000 is caught inside the apex of support and resistance, but as the consolidation appeared below support in what is increasingly looking like a failed 'bear trap', a push lower would appear to be the easier path.

The Semiconductor Index is working a swing low, but a solid move higher is required to confirm.

There is more to do for bulls to confirm the low. Today's action didn't give either side an advantage, but Friday might offer a firmer idea as to what is to follow. NFP data will not be left wanting.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I also trade on eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!