It was set up for bears with an easy gap down off the open, but buyers were able to put their foot down and drive a higher close. The next result was a mix of bullish piercing patterns and hammers. Up next will be getting past 50-day Moving Averages.

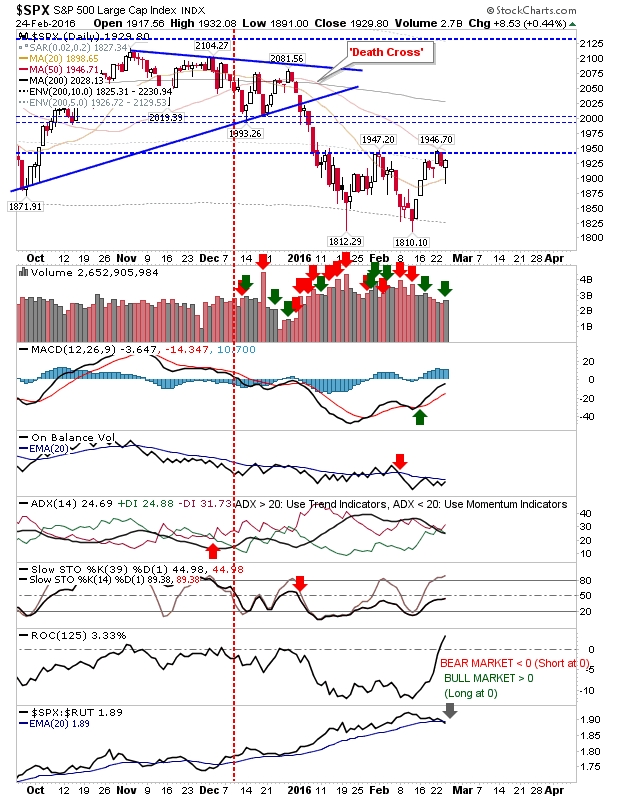

The S&P finished with a bullish hammer which leaves it knocking on the door of 1,950 again. Better still, the Rate of Change returned above zero with a new swing high, potentially ending the bear phase of the market. The 50-day MA is the next challenge, but there may be grounds for a push back to the 200-day MA.

The Nasdaq finished with an accumulation day. There is room to run before it gets to the 50-day MA. Rate of Change lies at zero, which is the switch point between bull and bear market. Relative strength is also improving against the S&P, suggesting further rotation out of safe Large Caps into more speculative Tech stocks.

The Russell 2000 also defended the 'bear trap' with a spike low into the trap zone. Momentum is turning in Small Caps favour as measured by relative performance against Large Caps and Tech Indices; this could be a key driver for the next phase of the rally.

Tomorrow will be about bulls kicking on and shorts covering. Yesterday did offer shorts opportunities at resistance, but today's action will be leaving many sweating overnight. The worst case scenario would be a surge higher on short covering, but then a slow return back to the open price - leaving behind a inverse hammer or doji. It will be important for buyers with intent to hold, participate in tomorrow's action, bringing with it a higher close.

You've now read my opinion, next read

Douglas' and

Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. I also trade on

eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!