Today offered the first real sign some form of capitulation kicked in. Volume was perhaps a little tame (although higher), but markets have reached a point where a short term bounce could be in the making. What may be of greater interest is what happens once we confirm a bounce is in effect. I suspect buyers will be reluctant to push prices beyond the November/December swing lows.

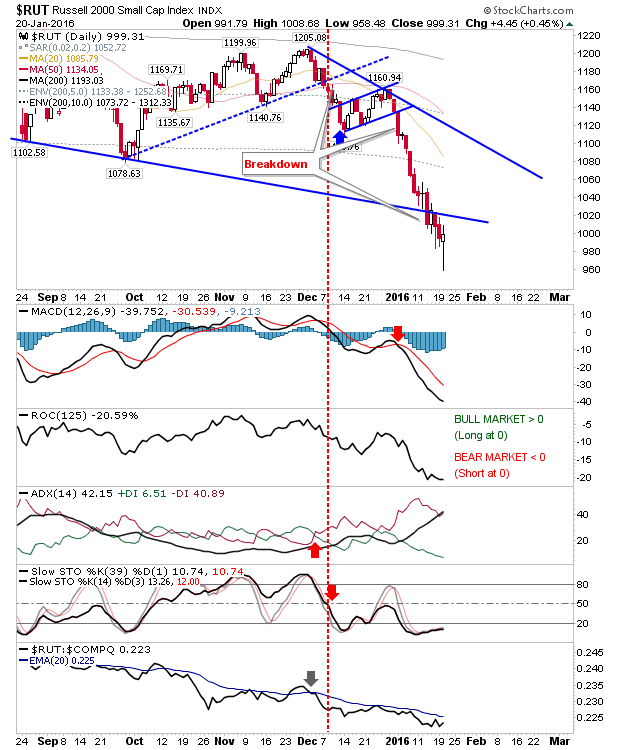

The Russell 2000 is the index which has suffered the greatest losses over the past few weeks and it was the first index to finish with a gain. The bullish 'hammer' is a bonus and today's intraday range included the 25% loss from all-time peak to current day lows. We have long since passed the period of historic weakness relative to its 200-day MA (deep inside the 5% zone of historic weakness). While today doesn't feel like a low-low (only a hunch), it's still likely to mark a trade-worthy low, much like August's and September's lows last year.

The Nasdaq tagged a low associated with the 10% band of historic weakness (although I track this metric by closing price, which wasn't reached today). There was decent capitulation volume and prices defended last August lows. Given the break in the Russell 2000, it's probable the Nasdaq has to fall out of its 2015 range before a true low emerges, but a good bounce could emerge here.

The S&P finished with a bullish 'hammer', just below support, but close enough to consider it a positive test given recent volatility. Watch for a bounce back to 2,000, with follow through potential to 200-day MA. After that, who knows.

While markets are down at levels of historic extreme weakness, the losses have the look of an early stage decline - particularly when one looks at weekly and monthly charts. While nobody can tell what happens next, long time buyers can look to build positions (but don't push all in!) and wait for the next swing low to add. Short term traders will want to see pre-market for leads; any push into today's spike lows will weaken the premise for a swing low. Such weakness would be enough to negate the short term trade, but long term buyers shouldn't be dissuaded.

You've now read my opinion, next read

Douglas' and

Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. I also trade on

eToro and can be copied for free.

JOIN ZIGNALS TODAY - IT'S FREE!