Small Caps Finish Strong

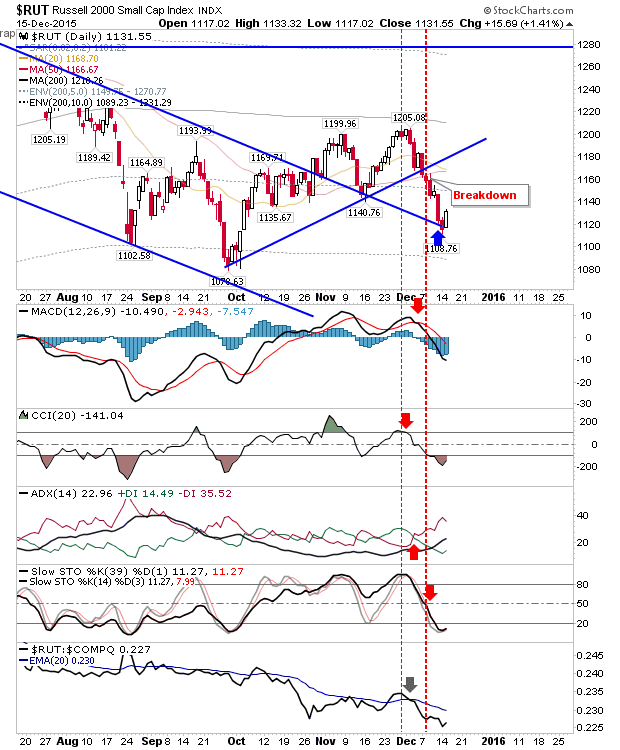

After an extended period of under performance for the Russell 2000, today saw it gain over a percentage point and close near the day's high. It's a positive response to the test of former channel resistance turned support, but it will have to watch supply as it approaches the moving averages.

The S&P was next on the performance charts. It started to struggle when it approached overhead moving averages. Despite higher volume accumulation, other indicators remained bearish. Tomorrow will see how much supply there is at converging moving averages.

The Nasdaq was the one disappointing index. It finished near the lows as the day with an indecisive doji. It does have the benefit of closing above its 200-day MA, but it will need to hold on to encourage buyers. Technicals are bearish, but On-Balance-Volume is close to a 'buy signal.

Tomorrow is a chance for bulls to add to today's gains. The Russell 2000 perhaps remains the value play for bulls looking value,while the semiconductor index also has merit. Note how it has rallied off the rising trendline.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P was next on the performance charts. It started to struggle when it approached overhead moving averages. Despite higher volume accumulation, other indicators remained bearish. Tomorrow will see how much supply there is at converging moving averages.

The Nasdaq was the one disappointing index. It finished near the lows as the day with an indecisive doji. It does have the benefit of closing above its 200-day MA, but it will need to hold on to encourage buyers. Technicals are bearish, but On-Balance-Volume is close to a 'buy signal.

Tomorrow is a chance for bulls to add to today's gains. The Russell 2000 perhaps remains the value play for bulls looking value,while the semiconductor index also has merit. Note how it has rallied off the rising trendline.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!