Losses consolidate

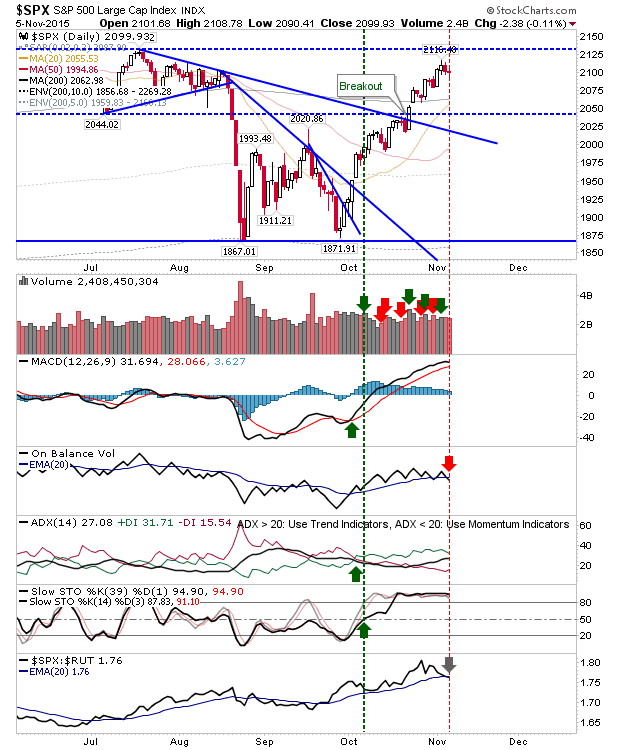

Today may have marked the second day of selling, but the selling was modest and nothing to threaten bulls. There were some minor technical changes.

The S&P triggered a 'sell' in On-Balance-Volume, and flashed a relative strength trigger loss against the Russell 2000. Howeve, the index is well away from either price support or resistance.

The Nasdaq, like the S&P, finished with a 'sell' trigger in On-Balance-Volume. And, like the S&P, is clear of support and resistance.

The Russell 2000 was able to close a little higher in a continuation of the bullish move off September lows. The gains haven't been dramatic, but like the hare and the tortoise the chance for it to be the year end winner are good. A return above the 200-day MA would really give confidence to buyers and wannabe buyers of the index.

Bears will be looking for losses to intensify in the Nasdaq 100. A 'bull trap' would give traders something to work with when other indices are offering little favourable risk:reward.

For tomorrow, bulls can keep their attention on the Russell 2000. Bears should watch for the 'bull trap' in the Nasdaq 100.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P triggered a 'sell' in On-Balance-Volume, and flashed a relative strength trigger loss against the Russell 2000. Howeve, the index is well away from either price support or resistance.

The Nasdaq, like the S&P, finished with a 'sell' trigger in On-Balance-Volume. And, like the S&P, is clear of support and resistance.

The Russell 2000 was able to close a little higher in a continuation of the bullish move off September lows. The gains haven't been dramatic, but like the hare and the tortoise the chance for it to be the year end winner are good. A return above the 200-day MA would really give confidence to buyers and wannabe buyers of the index.

Bears will be looking for losses to intensify in the Nasdaq 100. A 'bull trap' would give traders something to work with when other indices are offering little favourable risk:reward.

For tomorrow, bulls can keep their attention on the Russell 2000. Bears should watch for the 'bull trap' in the Nasdaq 100.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!