After the rally of the last couple of weeks, Friday's narrow range gains felt like it may offer bulls a break from their buying. There are a couple of resistance levels in play for some of the indices, but these have't played important roles in recent months as markets traded in narrow ranges.

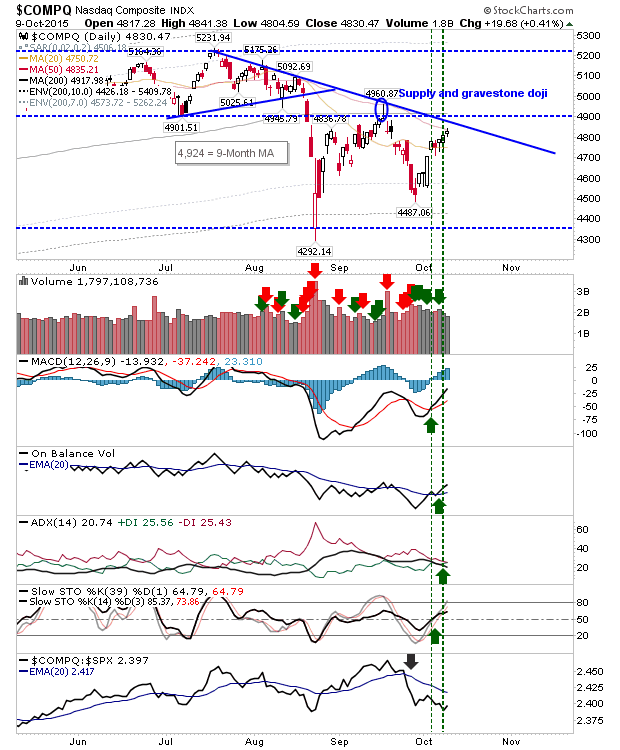

The Nasdaq is one such index. It finished Friday at its 50-day MA with a supply level lurking at 4,900 and declining resistance between it and 50-day MA.

The Nasdaq 100 broke declining resistance, but has the 200-day MA at 4,368 to consider. As it nicked the breakout Friday it may attract some buying interest on Monday. Look to pre-market for leads.

The S&P finished in a bit of a no-mans land on light volume. Swing traders will look to play a break of Friday's high/low. Technicals are net bullish and it's still clinging on to its relative advantage against the Russell 2000, but this has been steadily falling.

The Russell 2000 finally turned net bullish on Friday as it made it back to its 50-day MA. If sellers don't make an appearance on Monday then look for a push to channel resistance.

The Dow had already pushed past declining resistance and its 50-day MA and is now looking up to 17,625 resistance (from summer's trading range), which is also near its 200-day MA at 17,603.

Monday will offer bears another chance, but the swing trade opportunity could offer more with indices, particularly the Dow, offering room to the next point of resistance. Shorts can look to indices near 50-day MAs for reward.

You've now read my opinion, next read

Douglas' and

Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for

Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!