Markets Retain Majority of Gains

Not a day for big dramatics, but markets did well to hold on to Monday's gains. Selling volume was lighter than yesterday, so today wasn't seen as an opportunity to sell into strength. The one index which was perhaps a little problematic for bulls was the Russell 2000.

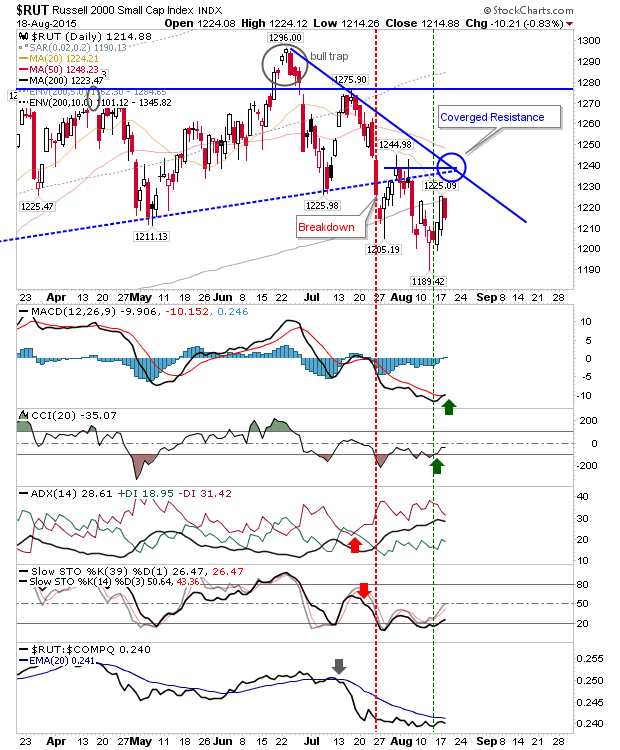

Here, the index lost nearly 1% as the 200-day MA stayed as resistance. This is he second time sellers have attacked this moving average. If bulls were to have a broader concern, then this index is the canary in the mine. Market leadership comes from Small Caps, and action in this index isn't great. Bulls may look to the weak MACD 'buy' as a sign of something better, but 1,189 will need to hold as support.

The S&P only experienced a small loss, and held breakout support. The 200-day MA is a key moving average to defend, as lose this and both Large and Small Caps Indices will be below this moving average, leaving Tech indices ploughing a lonely furrow.

The Nasdaq is trading in a no-mans land between 5,038 and 5,096. It's also a long way from the 200-day MA. This index will be looking to the S&P and Russell 2000 for leads.

For tomorrow, look for bulls to stick close to 200-day MAs. The biggest work to do will be in the Russell 2000. Even if there are gains, converged resistance will still need to be overcome.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Here, the index lost nearly 1% as the 200-day MA stayed as resistance. This is he second time sellers have attacked this moving average. If bulls were to have a broader concern, then this index is the canary in the mine. Market leadership comes from Small Caps, and action in this index isn't great. Bulls may look to the weak MACD 'buy' as a sign of something better, but 1,189 will need to hold as support.

The S&P only experienced a small loss, and held breakout support. The 200-day MA is a key moving average to defend, as lose this and both Large and Small Caps Indices will be below this moving average, leaving Tech indices ploughing a lonely furrow.

The Nasdaq is trading in a no-mans land between 5,038 and 5,096. It's also a long way from the 200-day MA. This index will be looking to the S&P and Russell 2000 for leads.

For tomorrow, look for bulls to stick close to 200-day MAs. The biggest work to do will be in the Russell 2000. Even if there are gains, converged resistance will still need to be overcome.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!