Distribution Seling

Yesterday's spike reversals came back to haunt the indices as markets followed yesterday's late selling with even more selling; selling which registered as distribution for some indices.

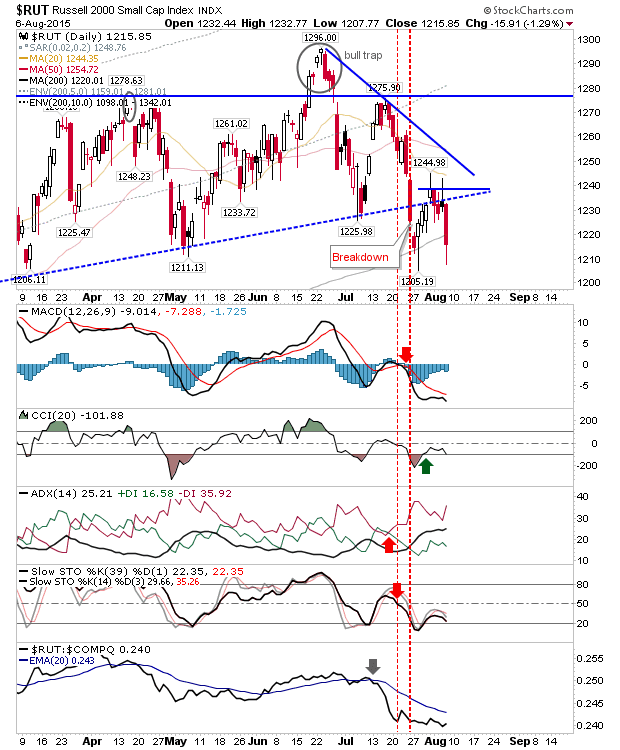

While the Dow is under the most pressure, the greatest disappointment was the Russell 2000. The selling resulted in an undercut of the 200-day MA, a break which followed soon after a recent successful test - a sign this test may not hold. Next key support is 1,210, and from there one is looking at tests of 1,100 and 1,040.

The Dow was the index struggling the most coming into today, but it had the smallest loss and volume was lighter. Is selling in this index coming to an end? Ideally, I would like to see a capitulation. However, the index hasn't dropped into the 'strong buy' territory marked by a loss of at least 10% below its 200-day MA.

The S&P experienced greater selling. It registered a distribution day and is on course to test its 200-day MA tomorrow. There are 'sell' triggers in the MACD and On-Balance-Volume, with support around 2,040 calling.

The Nasdaq finally experienced the kind of selling which had afflicted other indices. It's the strongest of the lead indices, and could tolerate further losses before it finds itself out of support opportunities. The biggest area for demand is 4,900, which is also converging with the 200-day MA.

The Semiconductor Index experienced losses which left it right on support of possible bullish wedge. If bulls are going to come out to play, this could be the index to do it.

We have NFP in the mix for tomorrow. Any semblance of a negative figure could push this selling into something more resembling a panic. As it stands, selling looks worse than it probably is. Indices are range bound, with the Dow the one index struggling in this regard. The Semiconductor Index is nicely set if there is a sniff of bullish momentum.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

While the Dow is under the most pressure, the greatest disappointment was the Russell 2000. The selling resulted in an undercut of the 200-day MA, a break which followed soon after a recent successful test - a sign this test may not hold. Next key support is 1,210, and from there one is looking at tests of 1,100 and 1,040.

The Dow was the index struggling the most coming into today, but it had the smallest loss and volume was lighter. Is selling in this index coming to an end? Ideally, I would like to see a capitulation. However, the index hasn't dropped into the 'strong buy' territory marked by a loss of at least 10% below its 200-day MA.

The S&P experienced greater selling. It registered a distribution day and is on course to test its 200-day MA tomorrow. There are 'sell' triggers in the MACD and On-Balance-Volume, with support around 2,040 calling.

The Nasdaq finally experienced the kind of selling which had afflicted other indices. It's the strongest of the lead indices, and could tolerate further losses before it finds itself out of support opportunities. The biggest area for demand is 4,900, which is also converging with the 200-day MA.

The Semiconductor Index experienced losses which left it right on support of possible bullish wedge. If bulls are going to come out to play, this could be the index to do it.

We have NFP in the mix for tomorrow. Any semblance of a negative figure could push this selling into something more resembling a panic. As it stands, selling looks worse than it probably is. Indices are range bound, with the Dow the one index struggling in this regard. The Semiconductor Index is nicely set if there is a sniff of bullish momentum.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!