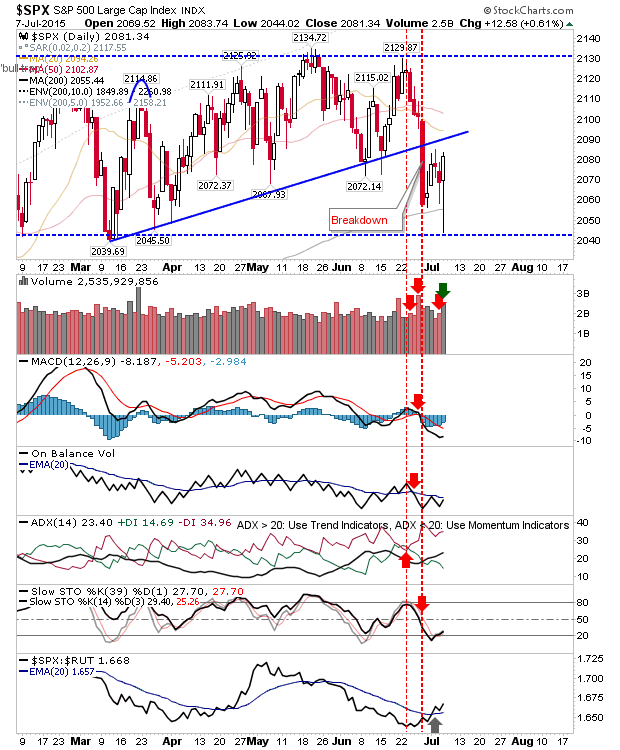

S&P To Break 2085?

A huge bullish reversal after an opening sell off leaves things nicely set for bulls tomorrow. The media attributed a recovery in oil prices to market gains (a rare attribution for oil prices!), but whatever the cause it was a big intraday swing.

The S&P spiked through 200-day MA support on heavy volume accumulation. Other technicals are net bearish, although the index is enjoying a relative performance against Small Caps.

The Nasdaq also spiked low, but not at major support. Although it wouldn't be hard to pick a swing low from previous scrappy trading to mark a support level.

The Russell 2000 also finished with a spike low. However, it did so inside a trading range - enough to readjust support to mark a possible bullish ascending triangle. Technicals are negative, and the index is underperformig relative to its peers.

If there is a disappointment to today it's that rallies jumped before markets had a chance to really become oversold. However, such wide range action is common at key lows and is common with capitulation, so it needs to be respected. Tomorrow is a chance to push on, but will Greece/China allow it.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P spiked through 200-day MA support on heavy volume accumulation. Other technicals are net bearish, although the index is enjoying a relative performance against Small Caps.

The Nasdaq also spiked low, but not at major support. Although it wouldn't be hard to pick a swing low from previous scrappy trading to mark a support level.

The Russell 2000 also finished with a spike low. However, it did so inside a trading range - enough to readjust support to mark a possible bullish ascending triangle. Technicals are negative, and the index is underperformig relative to its peers.

If there is a disappointment to today it's that rallies jumped before markets had a chance to really become oversold. However, such wide range action is common at key lows and is common with capitulation, so it needs to be respected. Tomorrow is a chance to push on, but will Greece/China allow it.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!