Pause in Decline

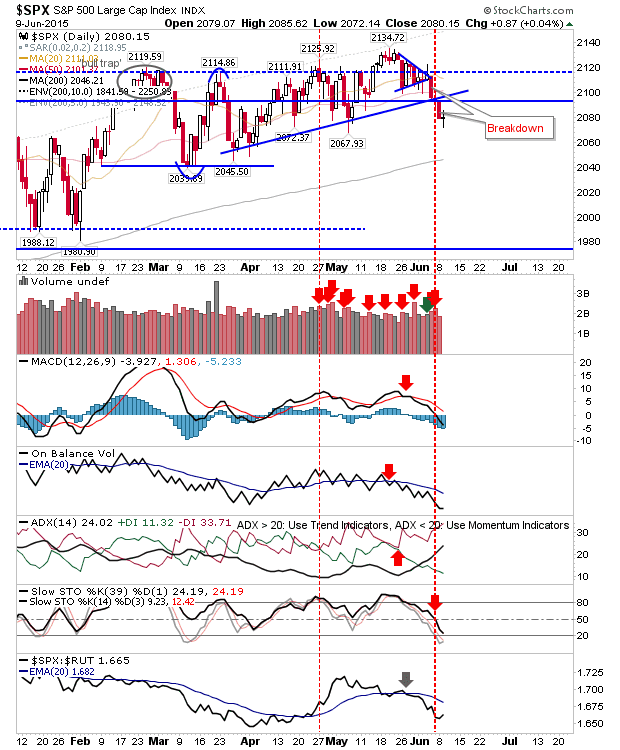

A day where the status quo was the end-of-day result after yesterday's selling. This is set up nicely for a rally tomorrow, even if some indices lack a natural support level to work off. Also favouring longs is the lighter volume selling which accompanied today's action. The S&P is net bearish at a technical level, but may find some traction at a minor swing low of 2,067.

The Nasdaq finished at bearish wedge support. The doji recovered enough ground to mark a spike low. If there is a concern, it's that volume rose in confirmed distribution.

The Russell 2000 had a quiet day. It's caught in the range of recent days, enough to redraw the channel which had earlier suggested a bullish breakout.

The Semiconductor Index tagged the 50-day MA, which is looking a good place for bulls to mount a challenge.

Premarket action should be a good guide. In the absence of key economic data, look for premarket levels near today's closing price to kick start the rally (and collectively, a bullish morning star).

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq finished at bearish wedge support. The doji recovered enough ground to mark a spike low. If there is a concern, it's that volume rose in confirmed distribution.

The Russell 2000 had a quiet day. It's caught in the range of recent days, enough to redraw the channel which had earlier suggested a bullish breakout.

The Semiconductor Index tagged the 50-day MA, which is looking a good place for bulls to mount a challenge.

Premarket action should be a good guide. In the absence of key economic data, look for premarket levels near today's closing price to kick start the rally (and collectively, a bullish morning star).

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!