Reverse of Thursday's Losses

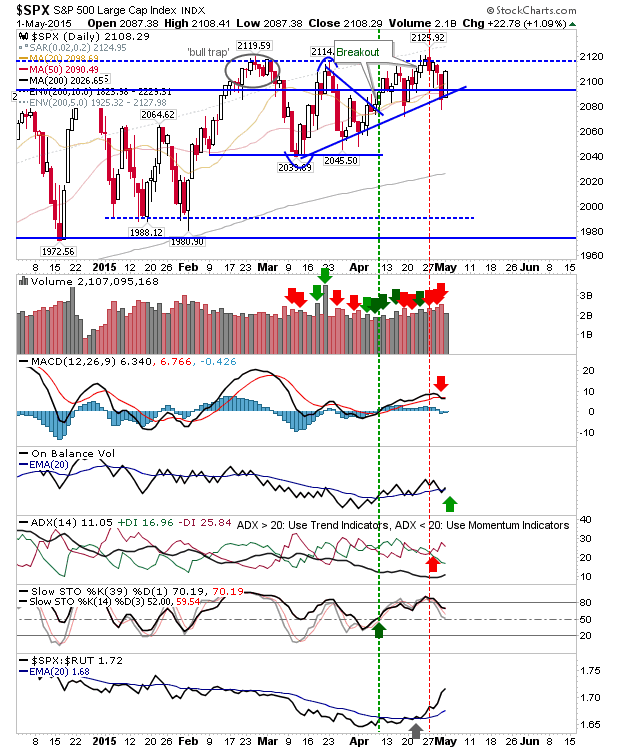

It was another day of to-and-fro for the markets, this time indices regained the ground they lost on Thursday. Although Friday's buying volume was lighter than Thursday's selling. The S&P had a mix of positive and negative technicals: 'sell' triggers in the MACD and +DI/-DI were countered by a 'buy' trigger in On-Balance-Volume. However, since February the only important levels of note are 2,120 resistance and rising trendline support - until these break market action is just noise.

Over the course of last week the Nasdaq changed its pattern from an attempted negation of a 'bull trap' to a bearish rising wedge. Techmicals are a little more bearish for this index with 'sell' triggers in MACD, On-Balance-Volume and +DI/-DI. Despite this, current action favours a push to wedge resistance.

The Russell 2000 has managed to dig in at a breakout support level of 1220. However, it has turned net bearish for technicals and is experiencing a sharp relative under-performance against both Large Caps and Technological indices.

The Nasdaq 100 has also offered itself as a bearish rising wedge, like the Nasdaq. Unlike the Nasdaq, Friday's rally has occurred from within the base, not from a position of support, which leaves the index a little isolated.

Helping the Nasdaq indices was the gain in the Semiconductor Index. The Index has got a little scrappy after a picture perfect move off the 'island reversal' from last year. This may yet broaden into a broader trading range between 660 and 730, but for now, look for a challenge of a potential downward channel.

Nasdaq breadth is showing worrying divergences, in particular with the percentage of Nasdaq stocks above both 50-day and 200-day MAs. A push to oversold levels would offer an opportunity for value buyers, and a test of demand. As it stands, breadth is a caught a little in the middle, which is playing into the bearish rising wedges exhibited by both Nasdaq indices.

Markets are caught in a bit of an impasse. Until new highs are posted, or rising trendlines broken, there is little more to say.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Over the course of last week the Nasdaq changed its pattern from an attempted negation of a 'bull trap' to a bearish rising wedge. Techmicals are a little more bearish for this index with 'sell' triggers in MACD, On-Balance-Volume and +DI/-DI. Despite this, current action favours a push to wedge resistance.

The Russell 2000 has managed to dig in at a breakout support level of 1220. However, it has turned net bearish for technicals and is experiencing a sharp relative under-performance against both Large Caps and Technological indices.

The Nasdaq 100 has also offered itself as a bearish rising wedge, like the Nasdaq. Unlike the Nasdaq, Friday's rally has occurred from within the base, not from a position of support, which leaves the index a little isolated.

Helping the Nasdaq indices was the gain in the Semiconductor Index. The Index has got a little scrappy after a picture perfect move off the 'island reversal' from last year. This may yet broaden into a broader trading range between 660 and 730, but for now, look for a challenge of a potential downward channel.

Nasdaq breadth is showing worrying divergences, in particular with the percentage of Nasdaq stocks above both 50-day and 200-day MAs. A push to oversold levels would offer an opportunity for value buyers, and a test of demand. As it stands, breadth is a caught a little in the middle, which is playing into the bearish rising wedges exhibited by both Nasdaq indices.

Markets are caught in a bit of an impasse. Until new highs are posted, or rising trendlines broken, there is little more to say.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!