Bulls Continue To Defend Recent Swing Lows

Today's losses took indices to test March lows before buyers stepped in to bring things back by the close.

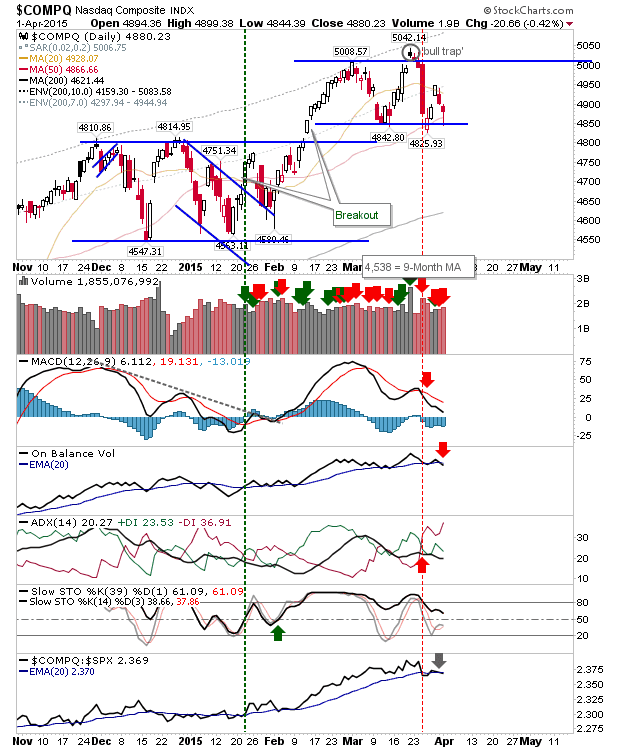

For the Nasdaq, bulls came in at the 50-day MA, although today's action registered as higher volume distribution.

The S&P didn't quite make it to the more significant March low, instead buyers stepped up on the test of last week's swing low. However, technicals returned to net bearishness, with on-balance-volume trending lower across the March double top; whatever late day buying there was, it was outgunned by the selling trend.

The Russell 2000 had the best of the day's action, finishing with a bullish doji which bounced off the 20-day MA. It also defended support at 1,243.

The Nasdaq 100 ranks as a rising wedge breakdown, with it sitting just above a thick band of support around 4,300. A solid day's decline would confirm a break and open up the 200-day MA as a target.

Fueling weakness in the Nasdaq is the bearish breakdown in the Semiconductor Index. It has already confirmed a double top on the loss of the 695 neckline. It too looks destined to test the 200-day MA.

For tomorrow, with the shortened week and job data due on Friday, today's weakness may flush itself out. Given the Semiconductor index has already confirmed a double top, it's hard to see other indices not doing likewise.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

For the Nasdaq, bulls came in at the 50-day MA, although today's action registered as higher volume distribution.

The S&P didn't quite make it to the more significant March low, instead buyers stepped up on the test of last week's swing low. However, technicals returned to net bearishness, with on-balance-volume trending lower across the March double top; whatever late day buying there was, it was outgunned by the selling trend.

The Russell 2000 had the best of the day's action, finishing with a bullish doji which bounced off the 20-day MA. It also defended support at 1,243.

The Nasdaq 100 ranks as a rising wedge breakdown, with it sitting just above a thick band of support around 4,300. A solid day's decline would confirm a break and open up the 200-day MA as a target.

Fueling weakness in the Nasdaq is the bearish breakdown in the Semiconductor Index. It has already confirmed a double top on the loss of the 695 neckline. It too looks destined to test the 200-day MA.

For tomorrow, with the shortened week and job data due on Friday, today's weakness may flush itself out. Given the Semiconductor index has already confirmed a double top, it's hard to see other indices not doing likewise.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!