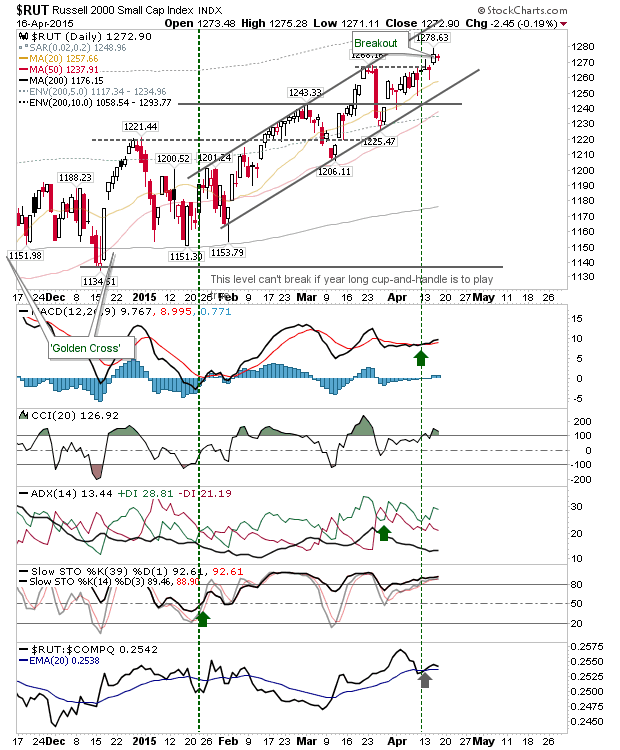

Breakout in Small Caps Hold Despite Small Sell Off

Sellers had a crack at reversing the breakout in the Russell 2000, but were unable to deliver a reversal. The index traded a very narrow range as technicals remained on the bullish side.

The S&P remains contained by recent highs and the 'bull trap', so today's losses were relatively inconsequential with support at 2093.

The Nasdaq is knocking around 5,000, but it hasn't yet come up against 5,042. It could do so tomorrow? Today's selling volume was less than yesterday's buying; another tick in favour of bulls.

The Nasdaq 100 is running against former support turned resistance. Shorts looking to pick on the bullish argument for Tech could look at this here.

The Semiconductor Index is another.

Tomorrow is split between bulls looking at the Russell 2000 (and potentially the Nasdaq), and bears at the Nasdaq 100 and Semiconductor Index. It's anyones game.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P remains contained by recent highs and the 'bull trap', so today's losses were relatively inconsequential with support at 2093.

The Nasdaq is knocking around 5,000, but it hasn't yet come up against 5,042. It could do so tomorrow? Today's selling volume was less than yesterday's buying; another tick in favour of bulls.

The Nasdaq 100 is running against former support turned resistance. Shorts looking to pick on the bullish argument for Tech could look at this here.

The Semiconductor Index is another.

Tomorrow is split between bulls looking at the Russell 2000 (and potentially the Nasdaq), and bears at the Nasdaq 100 and Semiconductor Index. It's anyones game.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!