Still No S&P Breakout

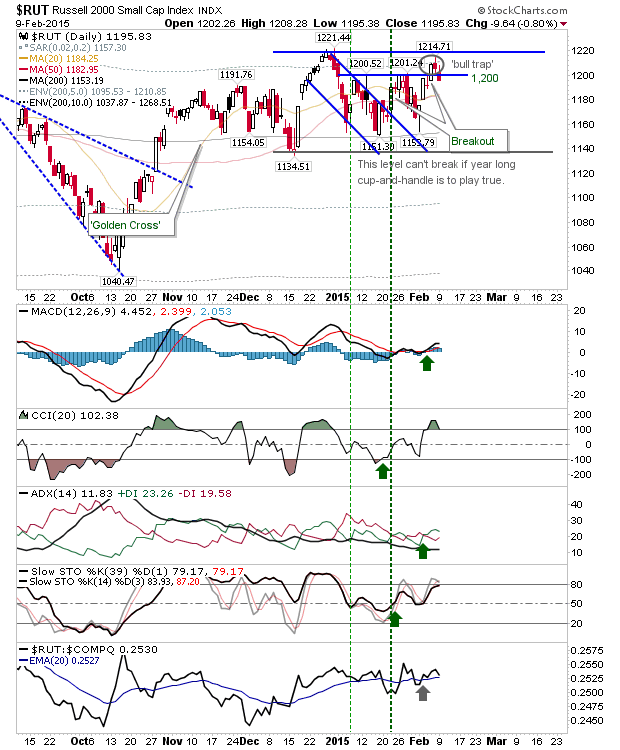

A second day of light losses kept markets relatively restrained. There was some technical change, but nothing too significant to shift the larger picture. The Russell 2000 gave up its breakout in a possible 'bull trap', and this needs to be watched closely if such a move is not to be confirmed with additional losses tomorrow. Note, this index is still range bound in a 'handle', so the 'bull trap' is not a particularly strong one.

The S&P was able to finish on its flat-lined 50-day MA, but it may find the legs tomorrow to deliver on the breakout. The loss of the Russell 2000 breakout is a concern, and this may bulls hesitant to come in here.

The Nasdaq is similarly restrained, although it did finish with a 'sell' trigger for On-Balance-Volume.

Bulls didn't suffer reversals everywhere. The Dow is hanging on to its channel breakout. Aggressive longs may use today's test of former resistance, turned support, as a buying opportunity. Stops go on a close inside of the declining channel.

For tomorrow, keep an eye on the Russell 2000. If there is continued weakness in premarket trading, then it will be hard to see the S&P or Nasdaq breaking to new near term highs.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P was able to finish on its flat-lined 50-day MA, but it may find the legs tomorrow to deliver on the breakout. The loss of the Russell 2000 breakout is a concern, and this may bulls hesitant to come in here.

The Nasdaq is similarly restrained, although it did finish with a 'sell' trigger for On-Balance-Volume.

Bulls didn't suffer reversals everywhere. The Dow is hanging on to its channel breakout. Aggressive longs may use today's test of former resistance, turned support, as a buying opportunity. Stops go on a close inside of the declining channel.

For tomorrow, keep an eye on the Russell 2000. If there is continued weakness in premarket trading, then it will be hard to see the S&P or Nasdaq breaking to new near term highs.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!