It wasn't the day I expected, but bulls can take some comfort it wasn't worse. Some indices fared better than others.

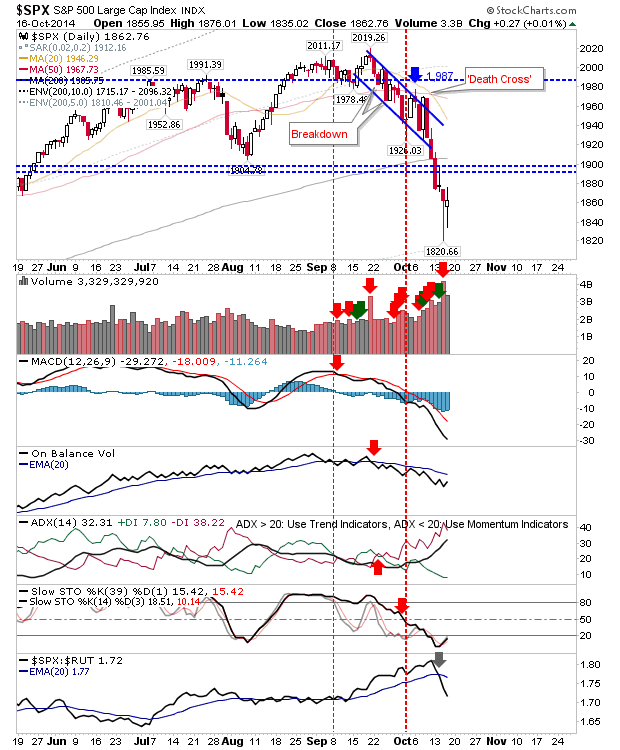

The S&P finished on the bearish side, despite closing a little higher. The inside day to yesterday's wide range day looks like something which will deliver more weakness in the days ahead. A close above yesterday's high would confirm a bottom (maybe not 'the' bottom), but this is something for tomorrow. A 2011 style bottom would still need another 5-6% decline to suggest this.

The Nasdaq had a better day than the S&P, closing with a bullish engulfing pattern. This should be enough for a retest of the 200-day MA, although risk on a loss of 4,116 isn't great. On an intraday time frame there are support levels around 4,200 and 4,180 which may be used as alternatives.

I was doubtful on the Russell 2000 breakout today when I saw European action, but in the end it delivered. The index finished with a tag of 1,090 resistance which might halt things, along with a fast falling 20-day MA, although it's more likely to go sideways from here. However, the index is enjoying a sharp relative advance against Tech and Large Caps as it looks like the worst of the selling may be behind it (or at least, near exhaustion).

As a final note, the Semiconductor Index is shaping a good bounce, with the gap breakdown ready to suck prices up.

For tomorrow, it looks like the Russell 2000, Nasdaq and Semiconductor Index are set up for gains tomorrow, but the S&P didn't do enough to escape the clutches of Wednesday's bearish action. Those looking to buy long term can probably find value (especially in Small Caps), but it may be prudent to build such positions over the next few weeks than take a chance this 'is' the bottom.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!