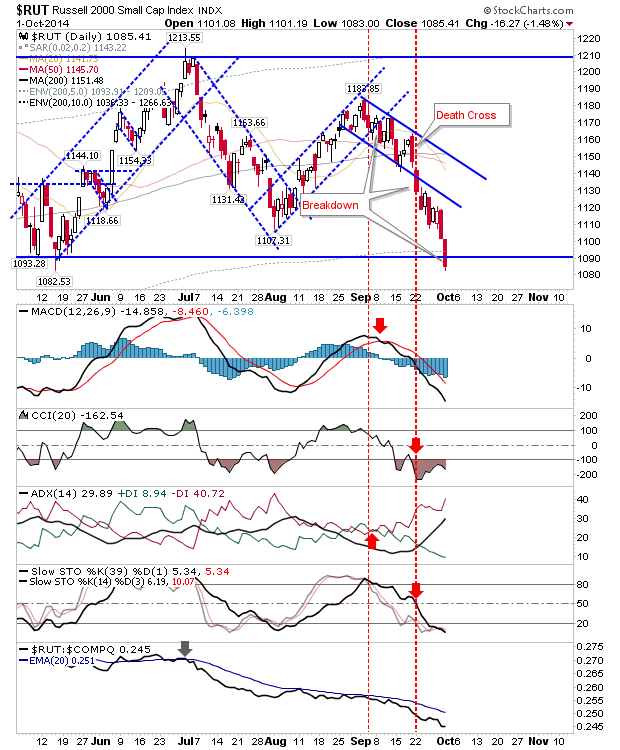

Bears haven't had too much to cheer as every sell off has been quickly reversed, but today they were given the run of the house. The Russell 2000 was the weakest index heading into today, and it was slapped with another big hit today. However, bulls probably have the best chance for a bounce trade in this index. The index saw a clear cut below the 200-day MA and 1,090, but a push above these levels tomorrow would set up a 'bear trap'.

The S&P was pushed into a no-mans land: it's no longer near support of 50-day MA or 1,987, and it has room to fall before it reaches August swing low and/or 200-day MA. Rallies from today will be sold into by shorts, with the 20-day MA likely to be the attack point. This will give weak rally opportunities for traders, although the Russell 2000 is probably the more attractive index in this regard.

The Nasdaq was the last index to break support, but it perhaps has the best support opportunities to lean on. The swing low at 4,325 will soon converge with the 200-day MA, and if the Nasdaq makes it back to this point it will offer a cover/long opportunity.

The Dow also took a big hit with a break of the 50-day MA, ending the consolidation trade between 50-day MA and 17,121. It's downward target is the 200-day MA, which is above the August swing low.

A short opportunity may be available in the Nasdaq 100. Here the August swing low was part of the April-September channel, which was breached on today's action. The next target down, after the August swing low, is the 200-day MA.

The best long standing short move has come from the Semiconductor index. Those who caught the 'bull trap' have been rewarded nicely. However, it will soon be dealing with converged support marked on the chart.

For tomorrow, shorts can look to the Nasdaq 100 for potential opportunities, particularly on any counter move back to channel support - turned resistance. Longs can look for the 'bear trap' in the Russell 2000: if tomorrow produces a rally there is a good chance the Russell 2000 will deliver on the 'bear trap'.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com, and Product Development Manager for

ActivateClients.com. You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!