Daily Market Commentary: Volatility Expands

After a series of relatively narrow intraday spreads, today was a day when the spread widened. It didn't change too much technically but it's a worry given bulls had started the day so brightly.

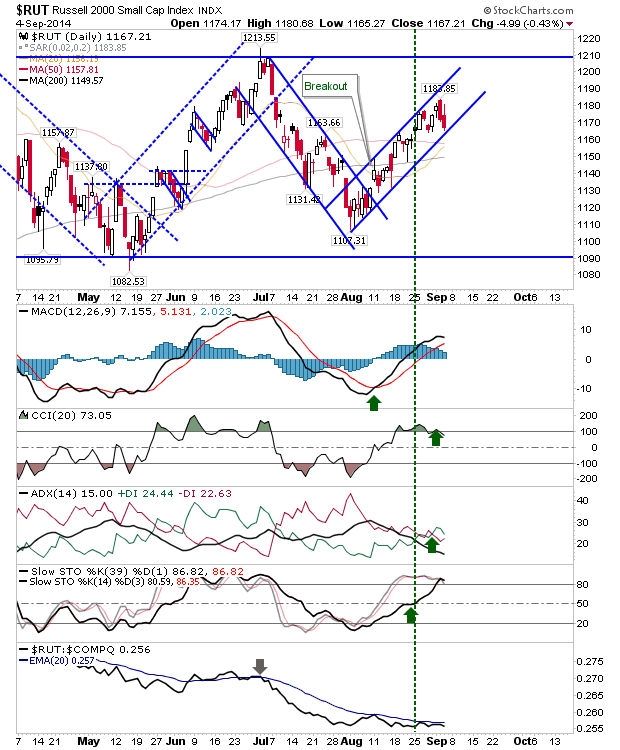

There are longside opportunities available. The Russell 2000 brushed against lower channel support and will offer a buying opportunity if the channel holds.

On the other side of the fence, the Semiconductor index tagged resistance with a bearish inverse 'hammer'. A loss of today's low is a possible shorting opportunity.

The S&P had a weak close, but a support break of 1,987 would mark a more bearish turn. Upper shadows of the candlesticks are lengthening, marking an increased level of supply (and fear). However, until there is a break of 1,987, today's losses don't change the net bullish rally

The Nasdaq is the least bearish. Today's losses changed little and could offer more like it. Even if losses continued, they would look more like a buying opportunity.

For tomorrow, look for a support bounce in the Russell 2000 and a resistance rebound in the Semiconductor index.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

There are longside opportunities available. The Russell 2000 brushed against lower channel support and will offer a buying opportunity if the channel holds.

On the other side of the fence, the Semiconductor index tagged resistance with a bearish inverse 'hammer'. A loss of today's low is a possible shorting opportunity.

The S&P had a weak close, but a support break of 1,987 would mark a more bearish turn. Upper shadows of the candlesticks are lengthening, marking an increased level of supply (and fear). However, until there is a break of 1,987, today's losses don't change the net bullish rally

The Nasdaq is the least bearish. Today's losses changed little and could offer more like it. Even if losses continued, they would look more like a buying opportunity.

For tomorrow, look for a support bounce in the Russell 2000 and a resistance rebound in the Semiconductor index.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!