Daily Market Commentary: Small Cap Channel Breakout

Bulls will not doubt have danced a little jig of joy on Friday's close, but as Thursday's selling ultimately proved, the lack of volume will place a big asterisk next to it. That's not to say there aren't areas of importance to watch.

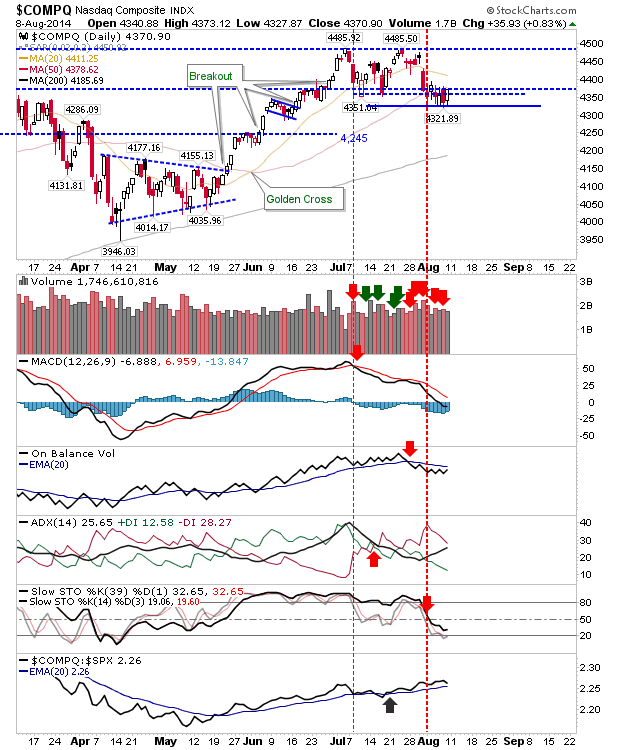

The Nasdaq has set up a defense line which will offer bulls a place for stops: a loss of 4,320 (on a close basis) would kill the nascent swing low in development. Stochastics haven't converged at oversold levels, so there may yet be a small bounce back to the 20-day MA before another push lower. Even so, buyers probably have more to gain from here forwards.

The percentage of Nasdaq Stocks above the 50-day MA is done at levels usually associated with a trade-worthy swing low. As in April-May, this bottoming process may take a few weeks, but the Nasdaq is probably trading at (or close to) a level buyers look prepared to defend. Other breadth indicators haven't shifted yet, so no confirmation of this swing low (yet).

The Russell 2000 was the one index which had looked more in the bear camp. Friday's buying nudged it above the channel line in a more marked bullish move, although it will soon find itself up against the 20-day MA and 200-day MA, with the 50-day MA in reserve to add supply. I would be more comfortable with another test of 1,090 before buying, but if it can power past these moving averages then that moment will likely be lost.

Finally, to round things out is the S&P. Little to add here. Potential buyers would be better to wait for 1,900 test; sellers can jump on a 'death cross' between 20-day and 50-day MAs or on a tag of the 20-day MA. Until then, it's caught in the middle.

Given the lack of volume with Friday's buying (and any volume we have seen has sided with selling) it's probable we will get some easing. Futures suggest a gap higher, which if true, may be faded at the open. Ideally, we will want to see buyers step in from 2 pm onwards into the close to suggest what we are looking at is in fact a tradeworthy swing low.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq has set up a defense line which will offer bulls a place for stops: a loss of 4,320 (on a close basis) would kill the nascent swing low in development. Stochastics haven't converged at oversold levels, so there may yet be a small bounce back to the 20-day MA before another push lower. Even so, buyers probably have more to gain from here forwards.

The percentage of Nasdaq Stocks above the 50-day MA is done at levels usually associated with a trade-worthy swing low. As in April-May, this bottoming process may take a few weeks, but the Nasdaq is probably trading at (or close to) a level buyers look prepared to defend. Other breadth indicators haven't shifted yet, so no confirmation of this swing low (yet).

Finally, to round things out is the S&P. Little to add here. Potential buyers would be better to wait for 1,900 test; sellers can jump on a 'death cross' between 20-day and 50-day MAs or on a tag of the 20-day MA. Until then, it's caught in the middle.

Given the lack of volume with Friday's buying (and any volume we have seen has sided with selling) it's probable we will get some easing. Futures suggest a gap higher, which if true, may be faded at the open. Ideally, we will want to see buyers step in from 2 pm onwards into the close to suggest what we are looking at is in fact a tradeworthy swing low.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!