Daily Market Commentary: Light Losses in Indices

Charts are turning into a scatter plot of doji. Today's losses didn't violate support and trading volume was light. Little to worry about here.

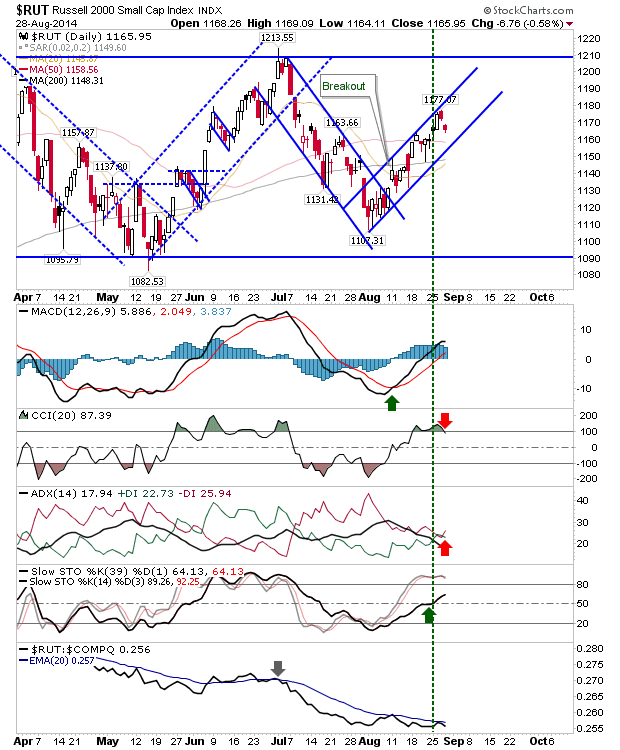

The Russell 2000 took the largest loss, but it's secure above its 50-day MA. The index is trading within a rising channel with a number of support levels, including the 50-day MA, to look too.

The S&P is holding above 1,987 support and technicals are in good shape. Today's action is a chance for bulls to add or initiate a position. Stops go a close below 1,987.

The Nasdaq has room to give up a little more before it comes back to support. Technicals are also in good shape too.

The semiconductor index managed to finish with a gain as it held yesterday's lows on early weakness. This is also good news for the Nasdaq and Nasdaq 100.

For Friday, look for further upside from the semiconductor index. Near term traders can look to the S&P which may find love at 1,987. No short candidates.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Russell 2000 took the largest loss, but it's secure above its 50-day MA. The index is trading within a rising channel with a number of support levels, including the 50-day MA, to look too.

The S&P is holding above 1,987 support and technicals are in good shape. Today's action is a chance for bulls to add or initiate a position. Stops go a close below 1,987.

The Nasdaq has room to give up a little more before it comes back to support. Technicals are also in good shape too.

For Friday, look for further upside from the semiconductor index. Near term traders can look to the S&P which may find love at 1,987. No short candidates.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!