Daily Market Commentary: Nasdaq Breakout II

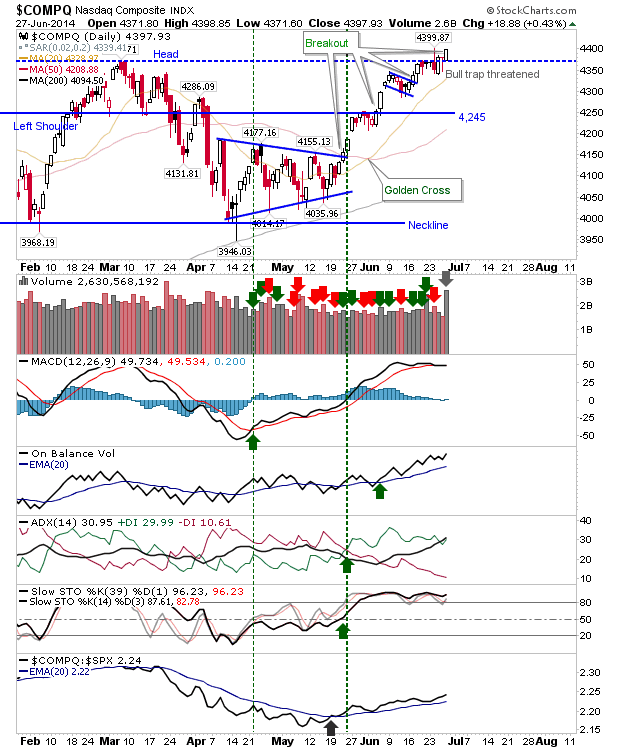

There was only one index at the races on Friday. Strong volume action, and the close above 'Head' resistance, suggests the Nasdaq breakout has finally taken. The 'Bull Trap' hasn't totally been negated, but Friday's action was a big dent in it.

The S&P had the volume, and last week's action does suggest a consolidation handle which may have the makings of a breakout for this week. The S&P did manage a positive test of its 20-day MA, which adds another tick to the probable upside breakout column.

The Russell 2000 had a solid day, enough to confirm a swing low from last week and set up a challenge of the March swing high. Early week weakness may offer a buying opportunity.

The Nasdaq 100 is about to come up against channel resistance, but with it well ahead of the Nasdaq, S&P and Russell 2000 it will attract buying interest.

Another trade opportunity can be found in the semiconductor index. The 20-day MA has been well defended so far and the chance of a 'bear trap' (a move above 638) remains high. Stops can go on decisive break of 20-day MA.

So, a few opportunities to watch for on Monday: breakout continuance in the Nasdaq and Nasdaq 100, pullback opportunity in Russell 2000, or 'bear trap' in semiconductor index.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P had the volume, and last week's action does suggest a consolidation handle which may have the makings of a breakout for this week. The S&P did manage a positive test of its 20-day MA, which adds another tick to the probable upside breakout column.

The Russell 2000 had a solid day, enough to confirm a swing low from last week and set up a challenge of the March swing high. Early week weakness may offer a buying opportunity.

The Nasdaq 100 is about to come up against channel resistance, but with it well ahead of the Nasdaq, S&P and Russell 2000 it will attract buying interest.

Another trade opportunity can be found in the semiconductor index. The 20-day MA has been well defended so far and the chance of a 'bear trap' (a move above 638) remains high. Stops can go on decisive break of 20-day MA.

So, a few opportunities to watch for on Monday: breakout continuance in the Nasdaq and Nasdaq 100, pullback opportunity in Russell 2000, or 'bear trap' in semiconductor index.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!