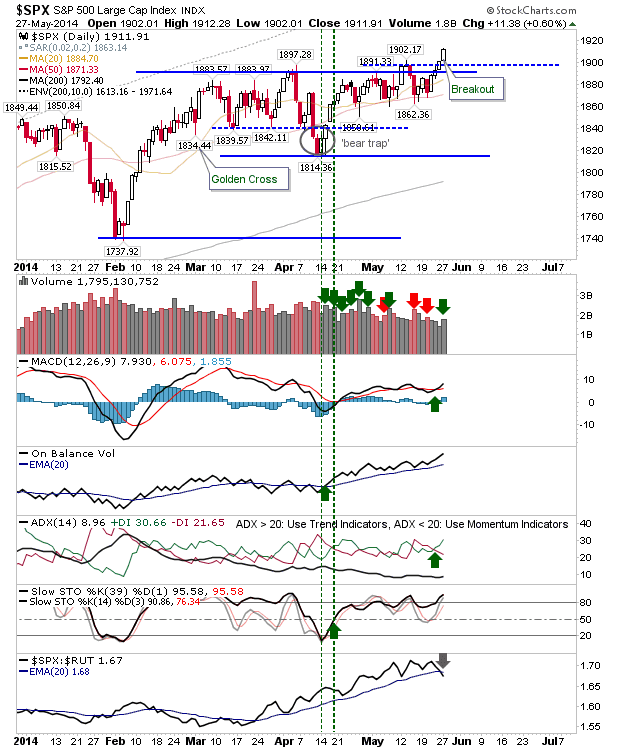

Daily Market Commentary: Bulls Add to Gains

Today saw bulls add to recent gains, doing so on higher volume accumulation. Better still, there was a continued swing towards more speculative issues - a good sign for the summer. The S&P may be at new all-time highs, but the relative swing away from it towards the Nasdaq and Russell 2000 continued.

The Nasdaq is at the point of challenging resistance of the head-and-shoulder pattern. If the rally stalls and reverses from here it will open up the possibility for such a (head-and-shoulder) reversal. Should it charge through, then the 4,371 high is the next target. Tomorrow will give an important indication as to what to expect.

The Russell 2000 experienced a short scramble. Today's gap higher was built by shorts, but also attracted value buyers, enough to push the index above its 50-day MA. The last four days have seen significant gains and some softness can be expected, but Technicals have probably seen sufficient improvement to suggest the short side opportunity is done.

For tomorrow, it maybe best to step aside: look to add/buy on weakness, but keep an eye on the Nasdaq head-and-shoulder in case it comes into play.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq is at the point of challenging resistance of the head-and-shoulder pattern. If the rally stalls and reverses from here it will open up the possibility for such a (head-and-shoulder) reversal. Should it charge through, then the 4,371 high is the next target. Tomorrow will give an important indication as to what to expect.

The Russell 2000 experienced a short scramble. Today's gap higher was built by shorts, but also attracted value buyers, enough to push the index above its 50-day MA. The last four days have seen significant gains and some softness can be expected, but Technicals have probably seen sufficient improvement to suggest the short side opportunity is done.

For tomorrow, it maybe best to step aside: look to add/buy on weakness, but keep an eye on the Nasdaq head-and-shoulder in case it comes into play.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!