Daily Market Commentary: Market Consolidation

There was to be no comeback by bears after Tuesday's rally supreme. Bulls can take significant comfort from the narrow action near Tuesday's highs. Look for more of the same with tight action offering a low risk swing opportunity: trade break of high/lows with a stop on the flip.

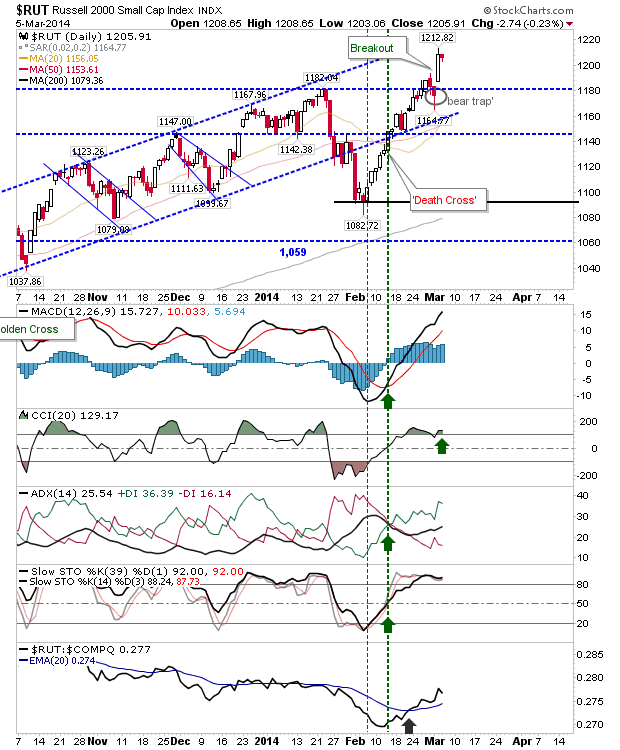

The Russell 2000 offers a neat example of this tight range, although the strength of the move suggests bulls are more likely to win out in the days ahead.

The S&P also offers a narrow intraday spread for a swing trade, although the proximity to support doesn't offer much room for a short trade.

The Nasdaq doesn't have the same opportunity, although the successful breakout backtest suggests only long positions should be considered.

The market doesn't want to reward shorts, but day traders may get something out of today's tight range. If the trade can survive the morning session it could be a nice (day) trade.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Russell 2000 offers a neat example of this tight range, although the strength of the move suggests bulls are more likely to win out in the days ahead.

The S&P also offers a narrow intraday spread for a swing trade, although the proximity to support doesn't offer much room for a short trade.

The Nasdaq doesn't have the same opportunity, although the successful breakout backtest suggests only long positions should be considered.

The market doesn't want to reward shorts, but day traders may get something out of today's tight range. If the trade can survive the morning session it could be a nice (day) trade.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!