Daily Market Commentary: Upside Follow Through

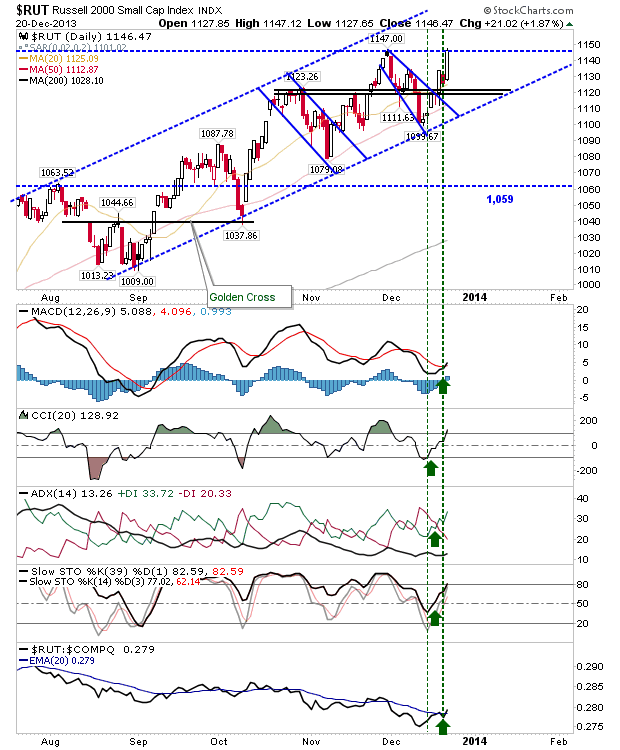

Markets got a second wind following improved economic activity. Volume climbed to the highest since June, no doubt a surprise for those traders expecting a quiet Christmas period. Better still, it was a good day for Small Caps, which missed out a little on the Fed bonanza.

The gain was good enough to reverse the net bearish turn in technicals, and swung relative strength back again in favour of Small Caps; although this has trended against Small Caps since the end of October relative to the Nasdaq.

The semiconductor index had a quiet Friday relative to the main indices, but more importantly. held its breakout.

The Nasdaq pushed a larger gain relative to the Semiconductor Index, bringing it up to channel resistance on a new MACD trigger 'buy', and a gain relative to the S&P. It's possible the Nasdaq is running into an acceleration of the trend dating back to October - if so, there shouldn't much stalling at the 'old' channel.

The Dow was the only disappointment, with a late day sell off to fire a warning shot over bull's bow for Monday.

Market Breadth is working a swing low, all part of a larger bearish divergence that this market is refusing to acknowledge.

Holiday trading probably favours the bulls, as bears have been quickly scared out of their short positions. The swing low in breadth offers something longer to work with, perhaps a rally of a few months in length?

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The gain was good enough to reverse the net bearish turn in technicals, and swung relative strength back again in favour of Small Caps; although this has trended against Small Caps since the end of October relative to the Nasdaq.

The semiconductor index had a quiet Friday relative to the main indices, but more importantly. held its breakout.

The Nasdaq pushed a larger gain relative to the Semiconductor Index, bringing it up to channel resistance on a new MACD trigger 'buy', and a gain relative to the S&P. It's possible the Nasdaq is running into an acceleration of the trend dating back to October - if so, there shouldn't much stalling at the 'old' channel.

The Dow was the only disappointment, with a late day sell off to fire a warning shot over bull's bow for Monday.

Market Breadth is working a swing low, all part of a larger bearish divergence that this market is refusing to acknowledge.

Holiday trading probably favours the bulls, as bears have been quickly scared out of their short positions. The swing low in breadth offers something longer to work with, perhaps a rally of a few months in length?

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!