Daily Market Commentary: Large Caps Wobble

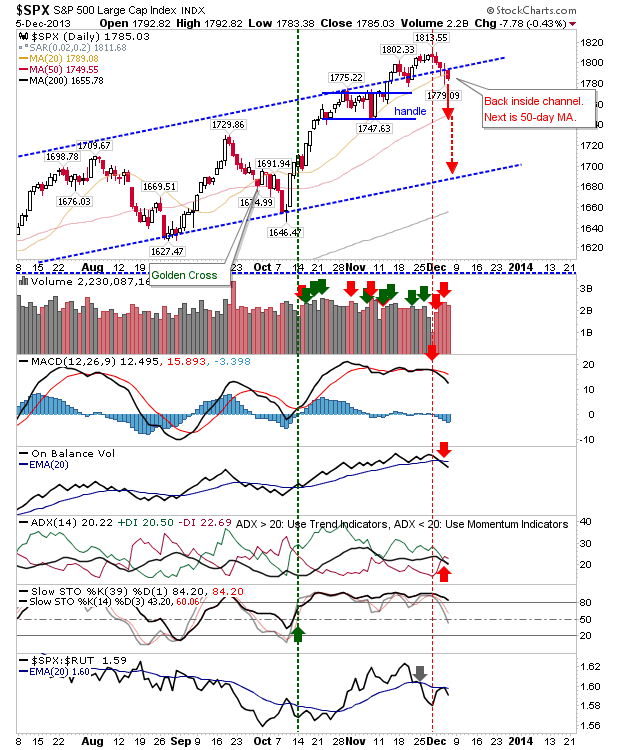

It has become a little more difficult for Large Caps following Thursday's losses. The November channel breakouts have now failed for both the Dow and the S&P, with the next move likely to be a challenge of the November swing low/50-day MA in the S&P, and 50-day MA for the Dow. Short plays in these indices can use a close above the 20-day MA as a cover.

Other indices were quiet. The Nasdaq and Nasdaq 100 traded in a very narrow range on modest volume. No alarm bells here.

Likewise, the Russell 2000 looks to be angling for support. Certainly shorts are finding it hard to push the index below its October swing high. A new MACD 'sell' trigger the only real change here.

In summary, new shorting opportunities in Large Cap indices, no change in Tech Indices, and bounce players can take a look at Small Caps.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Other indices were quiet. The Nasdaq and Nasdaq 100 traded in a very narrow range on modest volume. No alarm bells here.

Likewise, the Russell 2000 looks to be angling for support. Certainly shorts are finding it hard to push the index below its October swing high. A new MACD 'sell' trigger the only real change here.

In summary, new shorting opportunities in Large Cap indices, no change in Tech Indices, and bounce players can take a look at Small Caps.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!