Daily Market Commentary: Big Loss in Russell 2000

Trading volume was not particularly excessive as traders slowly crawl back to their trading desks after the holidays. However, what action there was sided with bears.

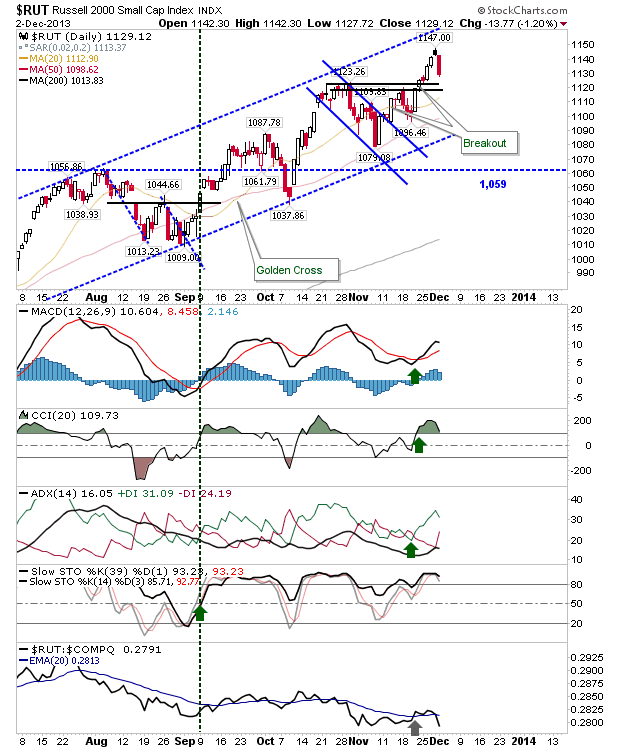

The small cap, Russell 2000, took the largest hit on the day, down over 1%. However, losses remained confined to the larger bull trend, so the real damage was relatively light.

Other indices took smaller losses. The S&P finished with a MACD trigger 'sell'', but the prior breakout still holds.

The Nasdaq is net bullish, with the channel breakout clinging on despite the minor loss.

It's early days, but further losses would be welcome to take some heat out of the market in the near term. The possibility of 'bull traps' in the S&P and Nasdaq is relatively high; this opens a shorting opportunity: stops on a move to new highs, downside target of 50-day MA, with a follow through opportunity to lower channel support.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The small cap, Russell 2000, took the largest hit on the day, down over 1%. However, losses remained confined to the larger bull trend, so the real damage was relatively light.

Other indices took smaller losses. The S&P finished with a MACD trigger 'sell'', but the prior breakout still holds.

The Nasdaq is net bullish, with the channel breakout clinging on despite the minor loss.

It's early days, but further losses would be welcome to take some heat out of the market in the near term. The possibility of 'bull traps' in the S&P and Nasdaq is relatively high; this opens a shorting opportunity: stops on a move to new highs, downside target of 50-day MA, with a follow through opportunity to lower channel support.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!