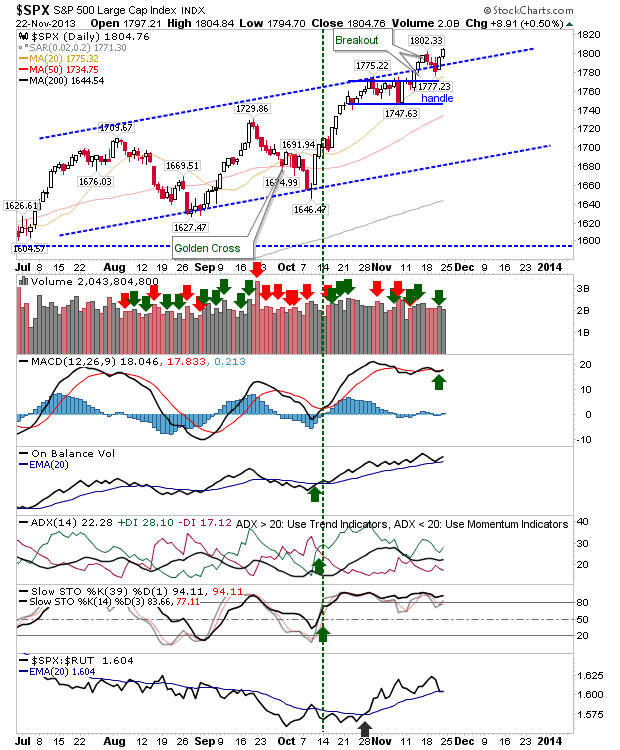

Daily Market Commentary: S&P Pushes New Highs

Large Caps regained the momentum lost by three days of selling from the first half of last week. Shorts in these markets will have covered on the break above 1,795, leaving them sidelined until the next opportunity arises. The shortened week is unlikely to offer too much guidance with Thanksgiving, so it will probably be a week featuring narrow range, but bullish action.

The last real hangout for shorts are the Tech indices. These haven't quite taken out the highs - but they are close to doing so. Technicals are slowly returning to their net bullish state. Volume just about registered as accumulation, although it did lack the bite to suggest there was sideline buyers coming in, and not just shorts covering.

The semiconductor index remains a shorts friend, but even here, a push above 509 would break that relationship.

As Nasdaq Breadth metrics are in the process of recovering, on their way to indicating an intermediate term swing low. First to change is typically the Percentage of Nasdaq Stocks above 50-day MA. This has jumped to 59% from a low of 54%, with a MACD trigger 'buy' and a pending 'buy' in +DI/-DI. The relative relationship between it and the Nasdaq has also provided a good leading indicator of change, and this has turned 'bullish'.

Although, the weekly picture needs more to suggest this is something other than short covering (which it appears to be for now).

The confirmation breadth metric for swing turns is the Nasdaq Summation Index. This is still net bearish, but even this is on the road to recovery.

The Russell 2000 is caught a little in the middle. It has managed a breakout - likely triggered by short covering - but it hasn't yet taken out the all-time high. However, technicals are the healthiest of the indices (if you are a buyer).

Don't expect too much form the week. Bulls will likely keep the shorts quiet until the start of December. Very hard to take the other side of the market as weakness is bid-up to new highs. Orderly profit taking remains favored course of action until we reach the next value period for buying big.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The last real hangout for shorts are the Tech indices. These haven't quite taken out the highs - but they are close to doing so. Technicals are slowly returning to their net bullish state. Volume just about registered as accumulation, although it did lack the bite to suggest there was sideline buyers coming in, and not just shorts covering.

The semiconductor index remains a shorts friend, but even here, a push above 509 would break that relationship.

As Nasdaq Breadth metrics are in the process of recovering, on their way to indicating an intermediate term swing low. First to change is typically the Percentage of Nasdaq Stocks above 50-day MA. This has jumped to 59% from a low of 54%, with a MACD trigger 'buy' and a pending 'buy' in +DI/-DI. The relative relationship between it and the Nasdaq has also provided a good leading indicator of change, and this has turned 'bullish'.

Although, the weekly picture needs more to suggest this is something other than short covering (which it appears to be for now).

The confirmation breadth metric for swing turns is the Nasdaq Summation Index. This is still net bearish, but even this is on the road to recovery.

The Russell 2000 is caught a little in the middle. It has managed a breakout - likely triggered by short covering - but it hasn't yet taken out the all-time high. However, technicals are the healthiest of the indices (if you are a buyer).

Don't expect too much form the week. Bulls will likely keep the shorts quiet until the start of December. Very hard to take the other side of the market as weakness is bid-up to new highs. Orderly profit taking remains favored course of action until we reach the next value period for buying big.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!