Daily Market Commentary: Thursday's gains undone

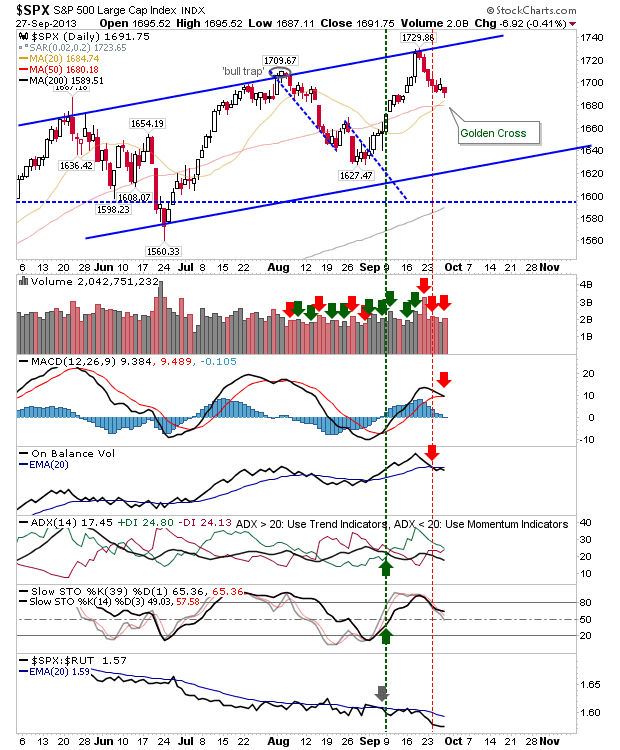

Bulls remain in good shape despite Friday's losses. The S&P exhibited a narrow loss, but with the 20-day MA just a few points below there is a good chance we will see a test on Monday. There was a new MACD trigger 'sell' to go with the On-Balance-Volume 'sell' of last week.

The Nasdaq is holding above its breakout with a 'bull flag' consolidation. Buyers can place a stop on a loss of 3,750. Technicals are all positive.

However, the semiconductor index does make things a little more difficult for the Tech indices with the break of former support (and the breakout reversal) giving something for the bears to work with. If you were itching for a short, this is the index to play - stops above 500 is a good place to start. Downside targets are the 50-day MA, with the 200-day MA if there is solid loss of the 50-day MA (a move to the 200-day MA will likely coincide with a retest of 450 swing low).

Bulls can look to the Nasdaq breadth indices which are in the bullish corner. There is plenty of room for upside in this breadth indices despite been closer to overbought conditions.

The Russell 2000 didn't make it past 1,077 - but Monday offers another opportunity for the index to do so. Bulls are best to focus on this index.

Monday's action is split into either a bullish Russell 2000 or a bearish semiconductor index. If market opens strong, then the Nasdaq and Nasdaq 100 will also come into play as decent long side opportunities (the latter in particular).

----

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq is holding above its breakout with a 'bull flag' consolidation. Buyers can place a stop on a loss of 3,750. Technicals are all positive.

However, the semiconductor index does make things a little more difficult for the Tech indices with the break of former support (and the breakout reversal) giving something for the bears to work with. If you were itching for a short, this is the index to play - stops above 500 is a good place to start. Downside targets are the 50-day MA, with the 200-day MA if there is solid loss of the 50-day MA (a move to the 200-day MA will likely coincide with a retest of 450 swing low).

Bulls can look to the Nasdaq breadth indices which are in the bullish corner. There is plenty of room for upside in this breadth indices despite been closer to overbought conditions.

The Russell 2000 didn't make it past 1,077 - but Monday offers another opportunity for the index to do so. Bulls are best to focus on this index.

Monday's action is split into either a bullish Russell 2000 or a bearish semiconductor index. If market opens strong, then the Nasdaq and Nasdaq 100 will also come into play as decent long side opportunities (the latter in particular).

----

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!