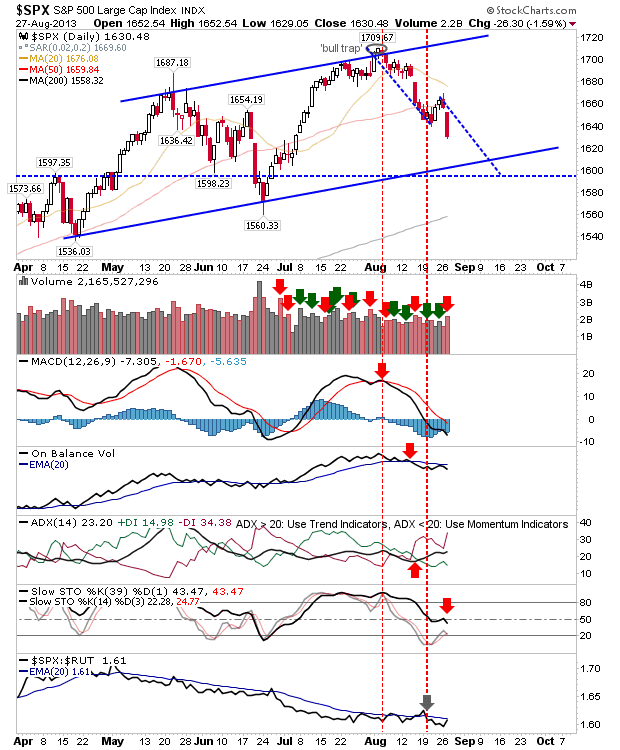

Daily Market Commentary: Bears Pressure For a Second Day

Bears continued where they left off from Monday with a solid day of selling. Volume climbed to register a distribution day. The extent of the selling, taking out August swing lows, sets up for measured move targets down. For the S&P, the downside target is the April breakout level just below 1,600.

While the measured move target for the Nasdaq is more shallow and doesn't reach the lower channel line (today's loss almost puts the index there).

Whereas the Russell 2000 has a measured move target below the channel line. However, today's sell off was enough to undercut the 50-day MA.

The Dow has already reached the lower channel and unlike the aforementioned indices its measured move target undercuts the 200-day MA and sets up a move back to March levels - this is an ugly chart, although for Wednesday there is a day trade long off channel support.

Other than the Dow channel support trade for tomorrow, a short trade to measured move targets is the preferred opportunity.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

While the measured move target for the Nasdaq is more shallow and doesn't reach the lower channel line (today's loss almost puts the index there).

Whereas the Russell 2000 has a measured move target below the channel line. However, today's sell off was enough to undercut the 50-day MA.

The Dow has already reached the lower channel and unlike the aforementioned indices its measured move target undercuts the 200-day MA and sets up a move back to March levels - this is an ugly chart, although for Wednesday there is a day trade long off channel support.

Other than the Dow channel support trade for tomorrow, a short trade to measured move targets is the preferred opportunity.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!