Daily Market Commentary: Net Bullish

It was a modest day for the markets, with morning gaps doing most of the leg work for bulls. However, there was enough strength in the market to break the net bearish turn in technicals for many of the indices, and all key indices are back supporting the long term bullish picture, ending the May-June decline. Pullbacks can be viewed as buying opportunities

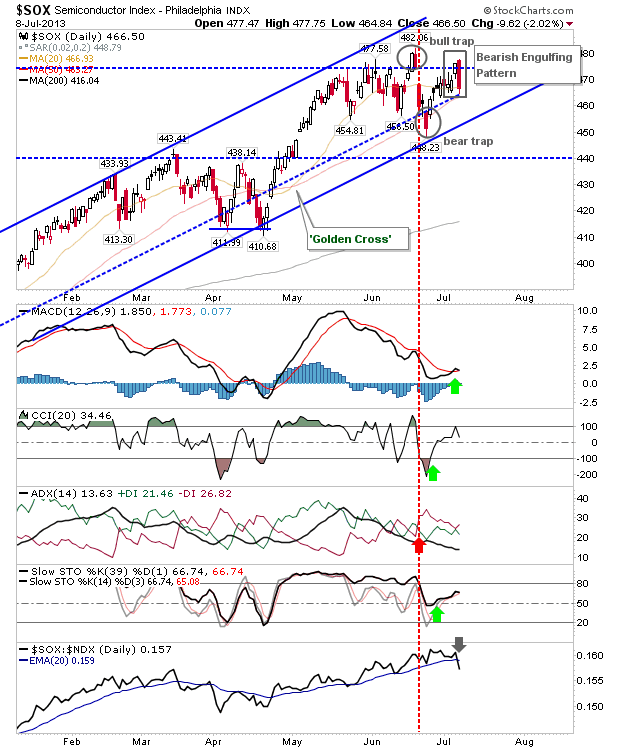

It's not all plain sailing for bulls. Resistance remains in play for certain indices and the semiconductor index posted a significant bearish engulfing pattern. If you are a short, or looking to short, this is the index to watch on Tuesday.

How this plays on Tuesday will influence the Nasdaq and Nasdaq 100. The Nasdaq 100 attempted a break of resistance, but closed the day just below this level and its open price. A stop at today's high is the risk measure for a short play tomorrow.

The Nasdaq is not as bearish having pushed itself into a price void above converged resistance. However, it will not be immune should selling in the semiconductor index expand.

The one index which could buck the trend is the Russell 2000. It posted a new high Friday and was able to build on it today, albeit to a small degree. A confirmation test of 1,000 is required, and given the sharpness of the advance, it's likely to come back more (risking a 'bull trap').

The S&P is caught in the middle. It regained its 50-day MA, but is back-testing former channel support turned resistance. It will likely take it's lead from the Nasdaq 100.

Bears have a good, relatively low risk, opportunity to push markets lower Tuesday. This will pressure the net bullish turn in technicals, but it will take a significant level of selling to turn all of them bearish again.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

It's not all plain sailing for bulls. Resistance remains in play for certain indices and the semiconductor index posted a significant bearish engulfing pattern. If you are a short, or looking to short, this is the index to watch on Tuesday.

How this plays on Tuesday will influence the Nasdaq and Nasdaq 100. The Nasdaq 100 attempted a break of resistance, but closed the day just below this level and its open price. A stop at today's high is the risk measure for a short play tomorrow.

The Nasdaq is not as bearish having pushed itself into a price void above converged resistance. However, it will not be immune should selling in the semiconductor index expand.

The one index which could buck the trend is the Russell 2000. It posted a new high Friday and was able to build on it today, albeit to a small degree. A confirmation test of 1,000 is required, and given the sharpness of the advance, it's likely to come back more (risking a 'bull trap').

The S&P is caught in the middle. It regained its 50-day MA, but is back-testing former channel support turned resistance. It will likely take it's lead from the Nasdaq 100.

Bears have a good, relatively low risk, opportunity to push markets lower Tuesday. This will pressure the net bullish turn in technicals, but it will take a significant level of selling to turn all of them bearish again.

---

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!