Daily Market Commentary: Bounce Continues

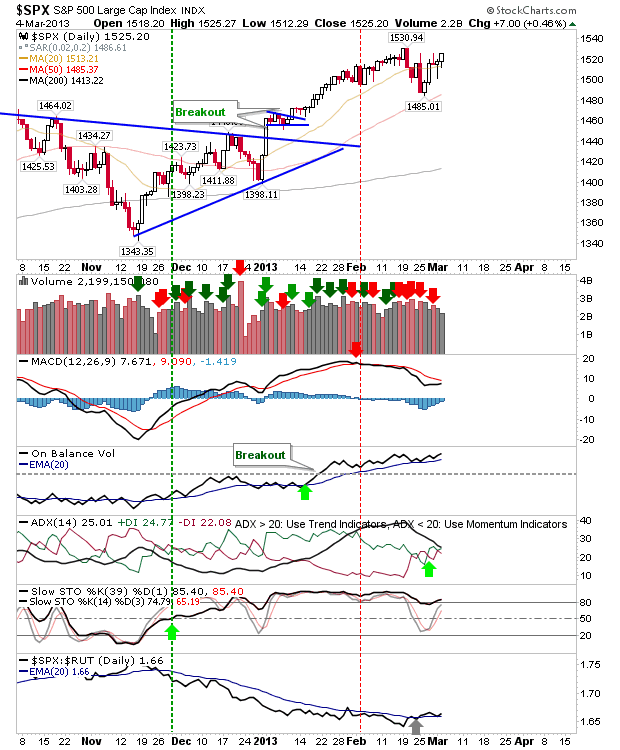

Markets posted a follow through gain to Friday's morning recovery, although volume was down. While the market is doing a good impression of a bounce, it continues to experience expanding breadth weakness. However, in a positive, 20-day MAs were regained as support.

The S&P is just 5 points from a new closing high and tomorrow may be the day it completes the pullback. The S&P is the lead index of the Russell 2000 and Nasdaq threesome. If a new high is posted it should come with a MACD trigger 'buy'.

The Nasdaq had mounted its bounce off its 50-day MA with a fresh bullish cross in On-Balance-Volume. The index performance continues to lag the S&P and Russell 2000, but it may benefit from rotation as it's due its moment in the sun. Like the S&P, it too is on the verge of a MACD trigger 'buy'.

The Russell 2000 has been the lead index since the November bottom, but relative strength does appear to be shifting away from speculative Small Caps towards Technology and Large Cap stocks.

While the November-March rally is likely on its last legs, there is still room for the Nasdaq and S&P to enjoy one last moment in the sun. The Russell 2000 looks to be turning into a follower - and not a leader. It's best days may be behind it (for the next few months).

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P is just 5 points from a new closing high and tomorrow may be the day it completes the pullback. The S&P is the lead index of the Russell 2000 and Nasdaq threesome. If a new high is posted it should come with a MACD trigger 'buy'.

The Nasdaq had mounted its bounce off its 50-day MA with a fresh bullish cross in On-Balance-Volume. The index performance continues to lag the S&P and Russell 2000, but it may benefit from rotation as it's due its moment in the sun. Like the S&P, it too is on the verge of a MACD trigger 'buy'.

The Russell 2000 has been the lead index since the November bottom, but relative strength does appear to be shifting away from speculative Small Caps towards Technology and Large Cap stocks.

While the November-March rally is likely on its last legs, there is still room for the Nasdaq and S&P to enjoy one last moment in the sun. The Russell 2000 looks to be turning into a follower - and not a leader. It's best days may be behind it (for the next few months).

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!