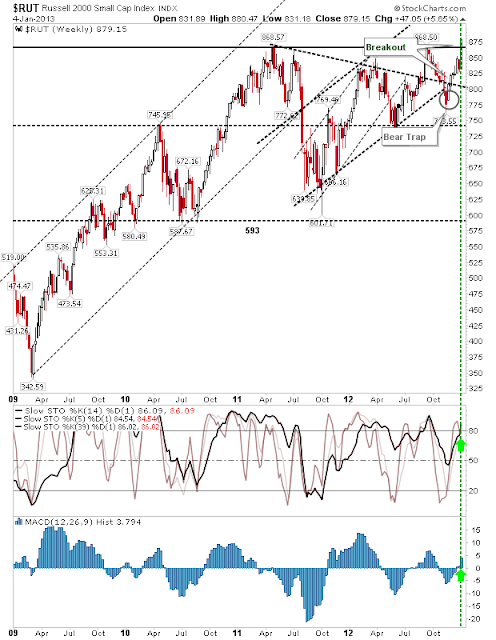

It was a good week for the indices, with the fiscal cliff nonsense resolving in bulls favor. The Russell 2000 was the star of the week as it made new multi-year highs. It handily cleared resistance on a net bullish turn in technicals. Bulls will want 868 to hold as end-of-week support if this is a valid breakout.

The Percentage of Nasdaq Stocks above 50-day MA is in overbought territory, although this rarely signals an absolute top, it does suggest those looking to buy are best to wait for the next pull back. Technically, this breadth metric turned net bullish.

The Nasdaq Bullish Percents also finished the week net bullish (in technicals). However, it is someway from overbought territory, which bodes well for a continuation of this rally (with the Percentage of Nasdaq Stocks above the 50-day MA marking a temporary swing high of a larger move).

It was the same for the Nasdaq Summation Index, which is neither overbought directly, or technically. Again, this favors further gains for the Nasdaq.

While the Nasdaq, with its improving breadth metrics, is challenging the 'bull trap' from earlier in 2012. Breadth metrics suggests the 'bull trap' will be negated.

While the S&P is about to follow the Russell 2000 to new highs, but hasn't quite got there yet.

The outlook remains positive for all indices. The Russell 2000 should continue its leadership role and remain the index for bulls to focus on. The Russell 2000 should also help drag the Nasdaq and S&P along for the ride.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!