If you are a bull, the past week's action has been very kind. Tight action, over an extended period, favors a big reaction move. The resulting move should come in the direction of the prior trend, which in this case is bullish. New longs can look to place a stop below the 5-day low. Aggressive players may wish to play a short on the break of the 5-day low as it would mark a 'fake out' of the bullish thesis (stops coming in above the 5-day high in this case).

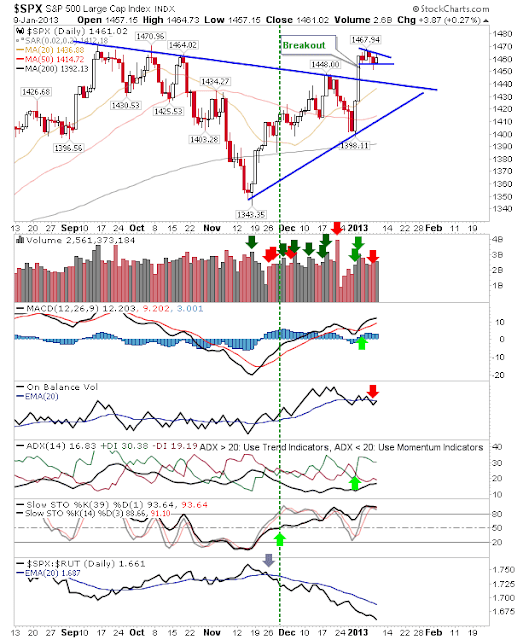

The S&P shows the bullish flag which 'should' break higher. Technicals are bullish (with the exception of On-Balance-Volume, although this is likely to turn bullish on the next up day).

Notice how the breakout gap in the Nasdaq hasn't been violated; another bullish sign. The only ugly is down trending On-Balance-Volume.

While the Russell 2000 is pressuring its high even within the tight consolidation. Look for this index to lead out the others.

For Thursday, keep an eye on the Russell 2000. If it can push above 881 in early trading it will offer a momentum scenario to drive buying for the rest of the day. This will bring the other indices along for the ride.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!