The day finished with a drop in

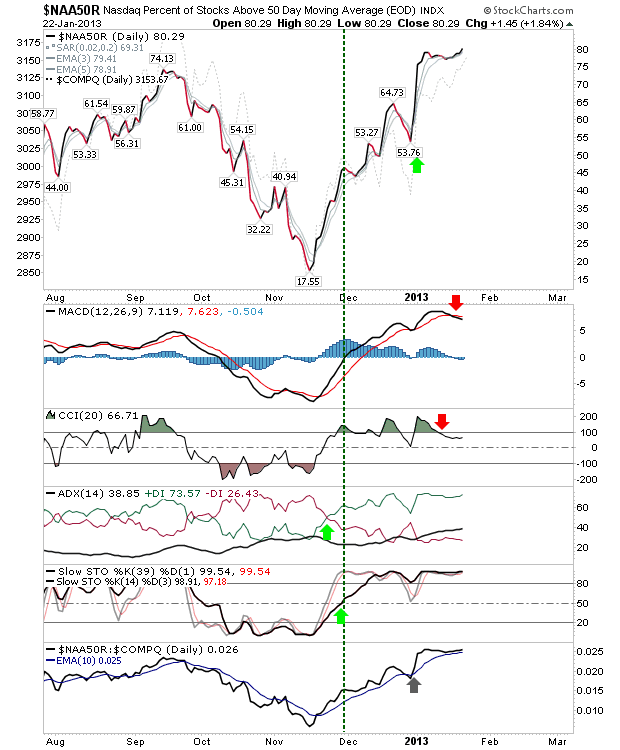

sector breadth strength, but markets (with the exception of the Russell 2000) posted gains. The Percentage of Nasdaq Stocks above the 50-day MA rolled higher, but technicals expanded on technical weakness, with a 'sell' in the MACD.

There is also a slowdown in the Nasdaq Bullish Percents.

While the Nasdaq gapped higher, but was unable to build on morning gains.

The semiconductor index maintained its run of good form having breached the September swing high. While the semiconductor index pushes higher it should bring along the Nasdaq and Nasdaq 100 for the ride.

The Dow closed at a new high, supported by a breakout in On-Balance-Volume.

The Russell 2000 posted a small loss, although the extended nature of its rally suggests a pullback to the 20-day MA would be preferable at this point.

Apple's

weak earnings is likely to dampen Thursday's action, but such action should be welcomed in the context of the broader rally given the short term extremes markets sit at.

----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!