As NY got to grips with the after effects of Hurricane Sandy, the market managed to add its 2 cents too. Buyers were quick to snap up stocks, particularly those of harder hit technology indices.

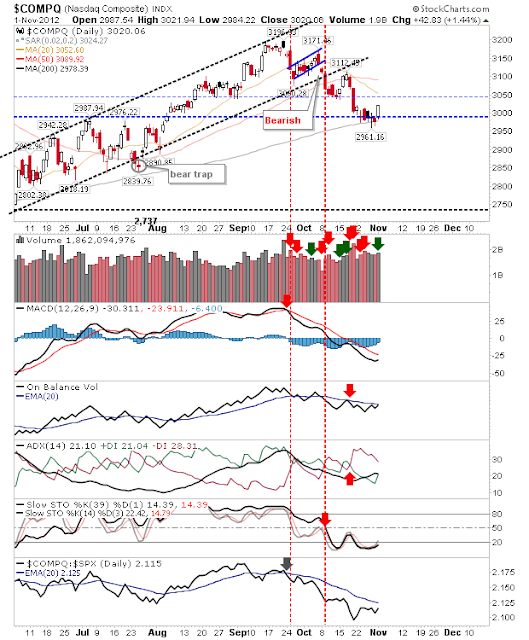

The Nasdaq has so far mounted a text book defense of its 200-day MA. Bulls jumped in with some gusto, but its next challenge is perhaps just a day away - the 20-day MA. Technicals held their bearish tone, but On-Balance-Volume may see a bullish cross tomorrow.

The leg work was done by the semiconductor index. It gained over 4% on the day, finishing above its 20-day MA. However, it continues to trade below its 200-day MA.

Small Caps were able to go a step further. While it didn't enjoy as much of a gain as did the Russell 2000, it was able to close above its 20-day MA; good news for Nasdaq watchers.

The biggest volume gain went with the Dow. Buyers have so far jumped the gun a little, with accumulation occurring before the 200-day MA was tested.

Tomorrow has an opportunity for more of the same, especially given the close above the 20-day MA in the Russell 2000 and the possibility for the same in the Nasdaq; supported by strength in the semiconductor index.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!