For a brief moment on Wednesday it had looked like bulls were going to get some change out of the market. But, by the close of business, bears had again reasserted themselves, and left indices close to, or at their lows.

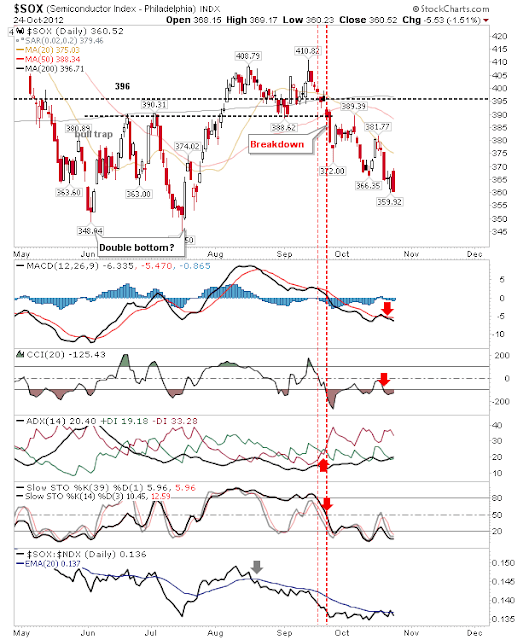

Hardest hit was again the Semiconductor index. It suffered a large intraday swing which left it looking downwards, towards the summer double bottom low around 348. If there is an inkling of a possible swing low, it's the bullish divergences in the CCI and MACD histogram, but technicals are otherwise bearish and have not indicated such a swing lows is in place.

The net effect of the selling in the semiconductor index was to leave the Nasdaq and Nasdaq 100 with another pass on their 200-day MAs. Selling volume has been heavy, particularly for the Nasdaq 100; since the September high there have been 8 distributions days to 1 accumulation day. Bulls buying the 200-day MA would want to be nimble on their feet if Thursday saw a close below this key long term support line. There is at least the benefit of a horizontal support level at 2,650 to work off too.

The Russell 2000 didn't lose much ground, but given the action in the Nasdaq and Nasdaq 100, it's hard to see it not making another run at its 200-day MA.

And Large Caps are now hindered somewhat by the weakness around them. The 200-day MA looks a long way down from where they finished Wednesday.

Bulls will probably focus on the Nasdaq and Nasdaq 100, which will likely offer some relief for these indices. The question is whether there is more on offer than perhaps 1 or 2 days of buying, particularly as sellers will likely continue their pressure on the S&P.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!