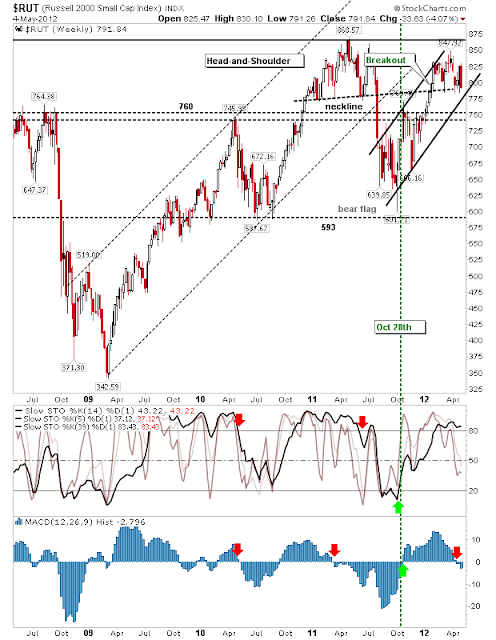

It was a tough week for markets with more speculative Small Cap and Tech Indices taking the brunt of the selling. Market breadth was similarly weak, although swing lows created for these indices weren't challenged.

Small Caps lost a hefty 4%, bringing the index back to neckline support. This is a buying opportunity although the nature of last week's selling suggests it's not quite done (perhaps a weak follow through on Monday/Tuesday). Technicals remain bullish and there are a number of support levels to play with in addition to neckline support; chiefly rising support and 760.

The Nasdaq suffered a 'sell' in the MACD histogram. Like the Russell 2000, selling was hard; but unlike the Russell 2000 it hasn't yet reached its first point of support. It's going to take a break of 2,885 to suggest something more bearish is going on.

But the Percentage of Nasdaq Stocks above the 50-day MA is more bullish than it was four weeks ago.

The S&P was the least effected by the week's selling. The index closed at 1,370 support and is well positioned for a push higher next week. Bulls may look to press their advantage with money rotating out of speculative issues into 'blue-chip' safety stocks.

Friday's selling may have undermined buyers on the daily time frame. but traders working off the weekly timeframe may find Monday's open more inviting.

-----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!