Monday traded like a holiday with low volume and a narrow intraday range. It was no coincidence this action occurred near resistance, with bulls doing little to challenge it.

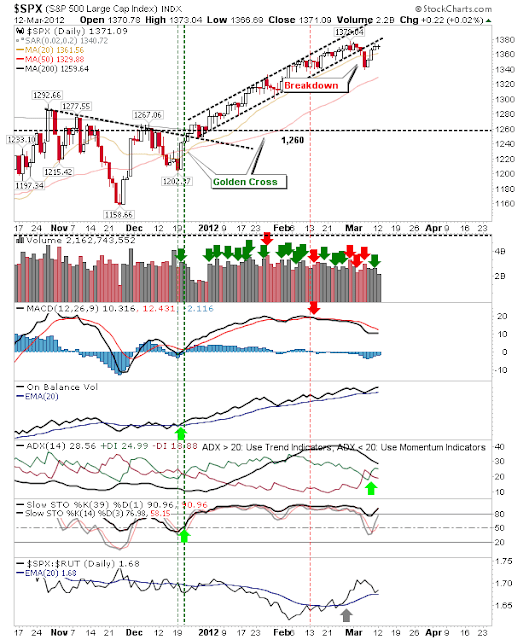

The S&P posted a small doji just below the February high. Technicals hed firm with the MACD on course to trigger a 'buy' and reverse its one bearish indicator. Swing traders can use a break of Monday's doji high/lows as the basis for a trade.

The Nasdaq experienced a similar day, closing slightly down. The index is sitting on the cusp of a challenge on 3,000.

But semiconductors suggest the Nasdaq might have to wait a little longer before it breaks 3,000. Today's semiconductor action was a clear reversal of Friday's gain, below February's congestion and away from its 20-day MA.

Small Caps are attempting a move inside the February congestion zone but it's encountering supply at its 20-day MA; a moving average both Nasdaq and S&P have cleared.

On Tuesday, look for swing trade opportunities off S&P and Nasdaq doji. A bearish break is more likely given weakness in semiconductors and the struggle in Small Caps.

----

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!