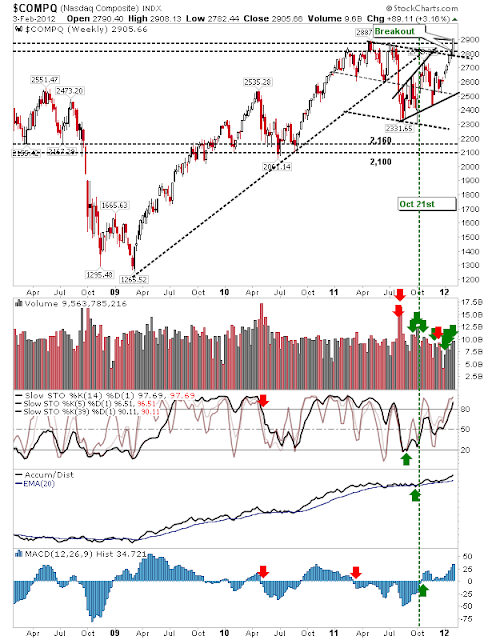

A good week for the indices and the Nasdaq in particular.

The Nasdaq pushed to a new multi-year high on higher volume accumulation. It has the look of a solid breakout which can probably withstand a few weeks of weakness before pushing on. Assuming a period of consolidation follows it will be important for 2,700 to hold.

Nasdaq Breadth continued to improve. The Percentage of Nasdaq stocks above the 50-day MA cleared a set of reaction highs dating back to the latter part of 2009, leaving the single swing high created from the rally off the March 2009 low at 83% as the last area of resistance. This strength may offer enough the groundwork for a 1 year+ rally.

The Nasdaq Bullish Percents have plenty of room to maneuver before turning overbought; another reason to suggest there is more to come.

There was another powerful push in the Summation Index, the fourth big move in a row - impressive stuff and one which suggests a slowing of this rally is another few weeks away.

The Russell 2000 had a good week, pushing inside the prior head-and-shoulder consolidation, but there is still room to run resistance and new highs.

The S&P has to clear 2011 highs before it can challenge the 2008 high. It did manage to finish the week higher, but not with confirmed accumulation.

The Nasdaq remains the index of choice for bulls. A period of weakness will offer sideline monies a chance to partake, but it will be important for 2,700 support to hold on the weekly timeframe. The Russell 2000 and S&P should come along for the ride, but are likely to lag action in Tech indices.

------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!