Daily Market Commentary: Dow Net Bullish

Despite it been Columbus day and the light trading volume to go with it bulls enjoyed a good day in a series of good days.

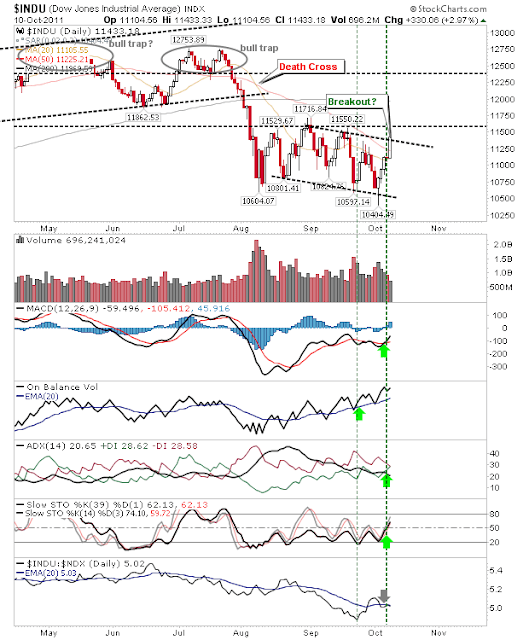

Best of the indices was the Dow Jones. Technicals improved to the extent it's now net bullish. There may be evidence for a break from a newly formed channel, but it will need volume (on an up day) to confirm. The rally cleared both 20-day and 50-day MAs with the 200-day MA the next upside target.

The S&P didn't quite share the glory of the Dow Jones but had a good day. It hasn't edged itself past its consolidation, but it did enjoy a MACD trigger 'buy' and a Stochastic 'buy' with a close above both 50-day and 20-day MAs. Relative strength swung back in its favour over more speculative Small Caps.

The Nasdaq cleared sharply declining resistance defined from early September on the back of a MACD trigger 'buy' and Stochastic 'buy'. Resistance at 2,616 is the next challenge.

While the Percentage of Nasdaq Stocks above the 50-day MA rose to 41%. It finished at broadening wedge resistance although with the bear trap in play the likelihood is for a continuation of the push higher.

The Russell 2000 might offer shorts the best chance for a play on Tuesday. The index closed right on the 50-day MA. Relative strength is reversing back in favour of Large Caps which adds to the weakness.

Despite the potential short setup the near term trend favours higher prices. The Dow perhaps offers the best chance for bulls. Given the low volume gain today the likelihood is for markets to ease back tomorrow. How these indices act at 20-day MA/50-day MAs - which should be support (with the exception of the Russell 2000) - will decide if there is a 'buy the pullback' opportunity. Helping bulls is a continued improvement in market breadth.

------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Best of the indices was the Dow Jones. Technicals improved to the extent it's now net bullish. There may be evidence for a break from a newly formed channel, but it will need volume (on an up day) to confirm. The rally cleared both 20-day and 50-day MAs with the 200-day MA the next upside target.

The S&P didn't quite share the glory of the Dow Jones but had a good day. It hasn't edged itself past its consolidation, but it did enjoy a MACD trigger 'buy' and a Stochastic 'buy' with a close above both 50-day and 20-day MAs. Relative strength swung back in its favour over more speculative Small Caps.

The Nasdaq cleared sharply declining resistance defined from early September on the back of a MACD trigger 'buy' and Stochastic 'buy'. Resistance at 2,616 is the next challenge.

While the Percentage of Nasdaq Stocks above the 50-day MA rose to 41%. It finished at broadening wedge resistance although with the bear trap in play the likelihood is for a continuation of the push higher.

The Russell 2000 might offer shorts the best chance for a play on Tuesday. The index closed right on the 50-day MA. Relative strength is reversing back in favour of Large Caps which adds to the weakness.

Despite the potential short setup the near term trend favours higher prices. The Dow perhaps offers the best chance for bulls. Given the low volume gain today the likelihood is for markets to ease back tomorrow. How these indices act at 20-day MA/50-day MAs - which should be support (with the exception of the Russell 2000) - will decide if there is a 'buy the pullback' opportunity. Helping bulls is a continued improvement in market breadth.

------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!