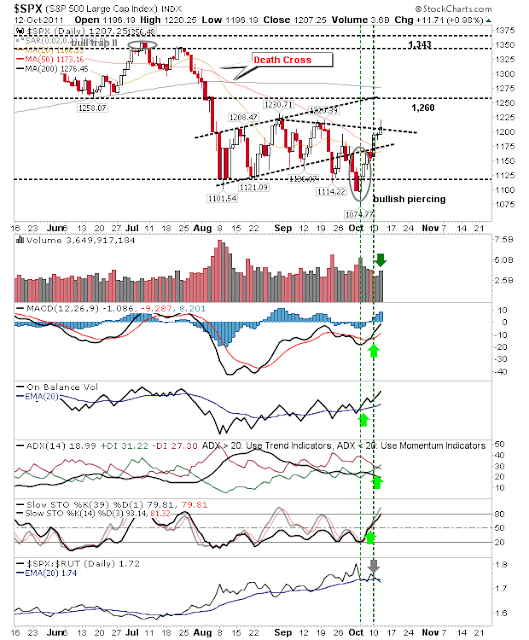

Bulls went to town and added another day of gains to this October rally. However, bulls were unable to push on from opening gaps. Volume climbed which may either rank as accumulation (because of higher prices) or churning (because markets closed at or below their opening levels).

The S&P had managed to clear declining resistance in early trading but sellers returned to bring it back below resistance. Technicals remain net bullish while relative strength shifted back to the Russell 2000.

The Nasdaq posted a 'shooting star' doji just below 2,616 resistance. This is likely to be a point where sellers take over for the next couple of days.

The Russell 2000 pushed above its 50-day MA but technicals haven't done enough to turn net bullish (yet). However, Small Caps have taken a leadership role over Tech (and Large Caps). The index is back inside the quagmire of the prior consolidation so it's likely to get scrappy from here. The 200-day MA is the logical upside target given the Nasdaq 100 is already there.

The Nasdaq 100 also exhibits a bearish 'shooting star' but it has the 200-day MA to lend itself as support.

The strongly improving Semiconductor index also finished with a bearish 'shooting star'

Tomorrow may see bears come to the fore, bringing indices back to 20-day and/or 50-day MAs. The substantial rally which has played out for the past seven days has left room for a move lower without damaging the nascent characteristics of the rally.

--------

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Trading Strategy Marketplace Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own strategy and sell it in the MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!