Bulls stepped up the buying to finish the week with net accumulation. The 'bear flags' across the different indices remain intact, but market breadth offers enough to suggest the rally will continue.

The S&P closed just a shade above a thick band of resistance at 1,209. It's a fine line as to whether it counts as a break or not. In favor of the bullish thesis is the stochastic 'buy' signal on the higher volume accumulation.

($SPX) via StockCharts.com

via StockCharts.com

The Percentage of S&P Stocks above the 50-day MA climbed to 43.8%. Even if the recent reaction low proved to be a false bottom as in October 2008, there is enough to suggest the rally could continue for another 1-2 weeks.

($SPXA50R) via StockCharts.com

via StockCharts.com

The rally in the Nasdaq took the index from bear flag support all the way to resistance. Volume buying was good, so there is reason for optimism for the 'bear flag' to break this week.

And the Nasdaq Bullish Percents also saw a 'buy' trigger in stochastics with resistance unlikely to kick in until it reaches 50% - it closed the week at 36%.

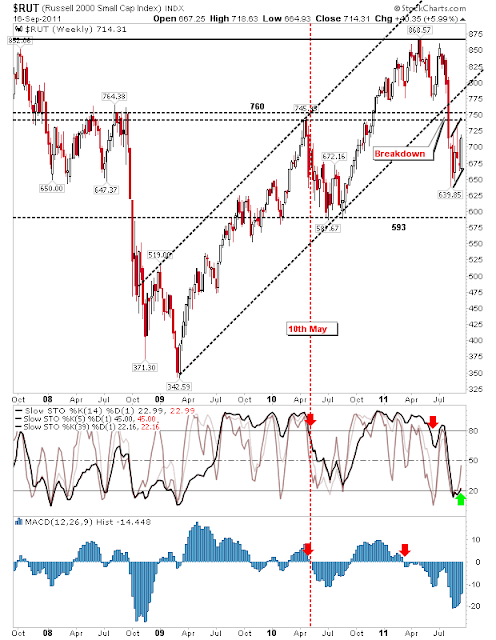

Finally, Small Caps also saw enough buying to see a 'buy' trigger in stochastics.

Conditions for a rally are still in place, despite the proximity of 'bear flag' resistance in the various indices. Markets are working themselves out of long-term oversold conditions which offers optimism a significant bottom is near, if not in place already.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Zignals Trading Strategy Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own

trading system and sell your

trading strategy in our MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN US TODAY - IT'S FREE!