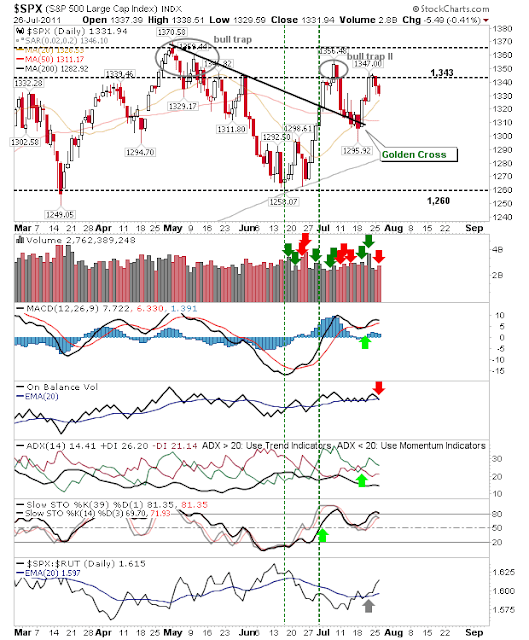

Bears were able to turn up the heat after a lackluster Monday. Volume climbed as sellers pressured markets towards their 20-day MAs, marking confirmed distribution.

The S&P didn't quite make it down to its 20-day MA, but it did suffer a 'sell' trigger in on-balance-volume. A confirmed test of the 20-day MA is likely Wednesday.

The Nasdaq finished with an inside day of an inside day. Trade break of 2,851 / 2,832 with a stop on the flip side. Technicals still net green but index trading inside 'bull trap' supply zone. Can it break higher?

The Nasdaq Summation Index is given an indication an intermediate top is in place. The clincher is the 'sell' trigger in the ratio between this index and the Bullish Percents. Will this be the catalyst for the next sell off (will Tuesday's inside day gap down)?

The Russell 2000 continues to break down. It was unable to hold 20-day MA support. Technicals poor and getting poorer.

But the index which will likely have the greater influence tomorrow is the semiconductor index. It has done well to come back from the 'bear trap', but it's now up against 50-day MA resistance and struggled today to make a break through despite early gains. The bearish shooting star is an additional tick in the trouble column.

The inside day in the Nasdaq (and Nasdaq 100 to a lesser extent) offers an opportunity to take advantage of the next swing. This swing is looking increasingly likely to be down - but you can never be certain! However, a gap down tomorrow would be a sizable move towards this.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for

Zignals.com. I offer a range of stock

trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the

Zignals Trading Strategy Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own

trading system and sell your

trading strategy in our MarketPlace to earn real cash.

You can read what others are saying about Zignals on

Investimonials.com.

JOIN US TODAY - IT'S FREE!