Daily Market Commenary: Bulls Rally

Buyers were prepared to come in from the sidelines, doing so with heavier volume accumulation. Bull traps remain an overhead supply concern. The Nasdaq is the index most likely to challenge this supply first (possibly tomorrow).

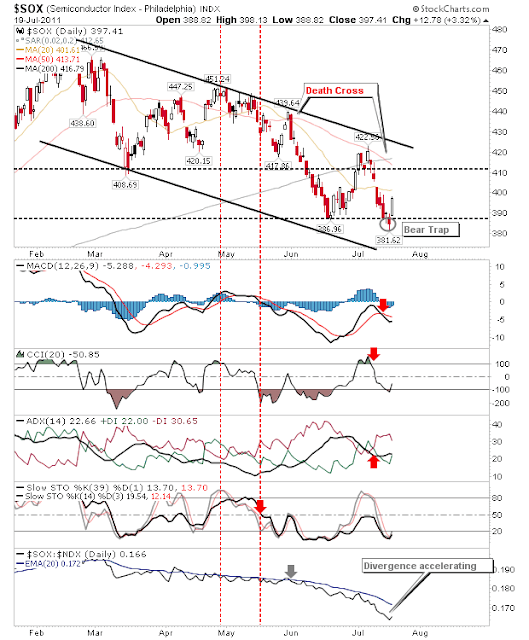

The real winner was the semiconductor index. It was able to recover with a bear trap, regaining 388 support. It's first level of supply to overcome is its 20-day MA at 401.61, before the 50-day MA comes into range.

The Nasdaq reversed the technical 'sell' triggers in the MACD and ADX and is less than 10 points away from challenging bull traps marked at 2,836 resistance. The reversal in the semiconductor index will help the Nasdaq going forward.

The S&P was able to recover from the 20-day MA, but has more room to maneuver higher before it can start challenging the bull traps.

Finally, the Russell 2000 rallied from declining resistance-turned-support, gaining over 2%. But like the S&P it will require a few more positive days before it can challenge the April bull trap.

The challenge for Wednesday is holding on to Tuesday's gains. Today's volume would suggest there is more to this recovery than just a single day's bounce. Bulls will want to see markets trading in the upper range of today's intraday spread. The semiconductor index may offer the best long side play, but its influence on the Nasdaq in consuming bull trap supply will also be key.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Zignals Trading Strategy Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!

The real winner was the semiconductor index. It was able to recover with a bear trap, regaining 388 support. It's first level of supply to overcome is its 20-day MA at 401.61, before the 50-day MA comes into range.

The Nasdaq reversed the technical 'sell' triggers in the MACD and ADX and is less than 10 points away from challenging bull traps marked at 2,836 resistance. The reversal in the semiconductor index will help the Nasdaq going forward.

The S&P was able to recover from the 20-day MA, but has more room to maneuver higher before it can start challenging the bull traps.

Finally, the Russell 2000 rallied from declining resistance-turned-support, gaining over 2%. But like the S&P it will require a few more positive days before it can challenge the April bull trap.

The challenge for Wednesday is holding on to Tuesday's gains. Today's volume would suggest there is more to this recovery than just a single day's bounce. Bulls will want to see markets trading in the upper range of today's intraday spread. The semiconductor index may offer the best long side play, but its influence on the Nasdaq in consuming bull trap supply will also be key.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Zignals Trading Strategy Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.

JOIN US TODAY - IT'S FREE!