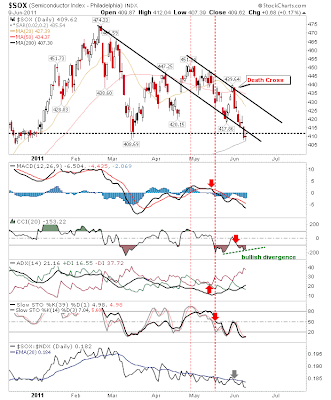

Daily Market Commentary: Semiconductor Index at 200-day MA

Best of the mix looks to be the semiconductor index. Semis closed with a small doji (bullish harami cross) right above its 200-day MA and along a line of support from the March swing low. Short and intermediate term stochastics are oversold.

The Nasdaq 100 closed at a minor support level of the April swing low. As with the semiconductor index, momentum is oversold. However, the 200-day and March reaction low are still some way off.

The S&P posted a low volume gain. The coming days may offer a more solid long play if early-buyers can squeeze shorts into a bear trap.

The Nasdaq is in a similar position, holding what was gap support from March.

The worry for bulls was the lack of volume associated with today's buying. If tomorrow can provide some impetus there may be enough to see a challenge of overhead 20-day MAs. A break, particularly in the semiconductor index, will likely keep buyers sidelined until 200-day MAs are tested. However, the semiconductor, having tested its 200-day MA, may not find its feet until down to November's 2010 swing low.

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. I offer a range of stock trading strategies for global markets which can be Previewed for Free with delayed trade signals. You can also view the top-10 best trading strategies for the US, UK, Europe and Rest-of-the-World in the Zignals Trading Strategy Leaderboard. The Leaderboard also supports advanced search capability so you can tailor your strategies to suit your individual requirements.

Zignals offers a full suite of FREE financial services including price and fundamental stock alerts, stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed stock quote watchlists, multi-currency portfolio manager, active stock screener with fundamental trading strategy support and trading system builder. Forex, precious metal and energy commodities too. Build your own trading system and sell your trading strategy in our MarketPlace to earn real cash.

You can read what others are saying about Zignals on Investimonials.com.