Markets were left with isolated black candlesticks on Friday after a series of gains - usually a sign of a top. How did the Stockcharters view this?

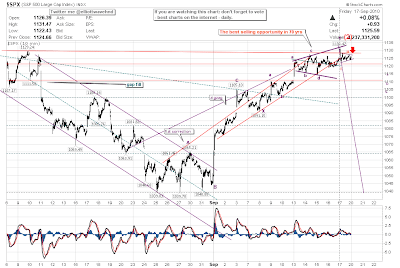

Anthony D Allyn of

Elliotwavehound.blogspot.com has an unusual comment on his 10-min S&P chart; not sure I would say it was the "best selling opportunity in 70 yrs" - maybe 70 minutes!

His 60-min S&P chart is no less forgiving

The Dow (daily) is similarly poised at a potential pivot reversal

Anthony Caldaro of

Objectiveelliotwave is looking at a final fifth wave high on the 60-min S&P chart before the ABC correction commences

He has a Nasdaq bear target of 1937-1942

Richard Lehman of the

Channelist.com notes a loss of bullish momentum, but that things still point upwards (for now)

9/16 -- Everything remains in green ST upchannels, though most charts indicate slope changes now. That means loss of momentum, but still heading up. A few things (QQQQ for example) are hitting upper lines on long term charts, others still have room on the upside before hitting a channel line of some sort.

9/14 -- The Fed did big POMO, the dollar tumbled, gold flew, and stocks tried to climb but at least held ground. The green short term upchannels have widened and are quite intact. However, stochastics are back to extremes and things are overbought. Hmmmm...what can the Fed do tomorrow to goose the market???

9/13 -- The Dow and SPX hit their LT purple lines today while the small cap indexes went flying right through them to the upside. I've drawn blue minichannels on the long term charts to show where this upward move might end. There's probably a bit more room to it, but stochastics on the LT charts are already at extremes now and could curl back down at almost any time.

Gold is just starting to weaken on the mid and long charts. It may be time for a correction there as well.

9/12 -- The green channels remain intact, or in some cases may be widening. That means another leg up in the ST channel is likely this week. But long term resistance form the big purples will be felt. Watch the ST green for a break, even if it bounces first.

9/9 -- The morning rally couldn't hold, but almost everything remains in the green ST upchannels, so another little upmove is still possible tomorrow. But I think this was an induced rally that is not going to last much longer. If it only went a little higher and then reversed down through the green lines, the long term purple downchannels will essentially still be intact. I still see more downside than upside in equities right now.

Yong Pan of

Cobrasmarketview still has a remarkably neutral outlook on the market; a single 'sell' signal creeping in on the intermediate time frame (although three existing 'buy' signals too)

The intermediate time frame 'buys' are looking a little tired as they ride a support line

The black candlestick is always a bad omen at a top of a rally. The market got away with it earlier this month - can it do so again?

Has

Michael Eckert of

EWTrendsandcharts.blogspot.com pin-pointed a top in the S&P?

Although there is a bullish (but not favoured) alternative:

So will it be all hands-on-deck for Monday?

Follow Me on Twitter

Build a Trading Strategy Business in Zignals

Dr. Declan Fallon, Senior Market Technician for

Zignals.com, offers a range of stock

trading strategies for global markets, also available through the latest rich internet application for finance, the

Zignals MarketPortal or the Zignals

Trading Strategy MarketPlace.

Zignals offers a full suite of financial services including price and fundamental

stock alerts,

stock charts for Indian, Australian, Frankfurt, Euronext, UK, Ireland and Canadian stocks, tabbed

stock quote watchlists, multi-currency

portfolio manager, active

stock screener with fundamental trading strategy support and

trading system builder. Forex, precious metal and energy commodities too. Build your own

trading system and sell your

trading strategy in our MarketPlace to earn real cash. Read what others are saying about Zignals on

Investimonials.com.

JOIN US TODAY - IT'S FREE!